Can I Deduct Gas As A Business Expense

Gas receipts for business expenses. In order to deduct it keep track of your business miles and multiply the total mileage amount by 54 the 2016 standard mileage rate.

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

can i deduct gas as a business expense

can i deduct gas as a business expense is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i deduct gas as a business expense content depends on the source site. We hope you do not use it for commercial purposes.

You can write off your mileage for the year including your business charity and medical trips.

Can i deduct gas as a business expense. Taxes you can deduct various federal state local and foreign taxes directly attributable to your trade or business as business expenses. If your employer. If you received mileage or gas reimbursement from your employer you cant deduct those costs.

If you use this deduction you cant additionally write off insurance or gas because its already. The tax deduction section is different for each business type. Alternatively you can use the actual expense method to deduct the business portion of things like gas oil maintenance and.

One type of deduction that many small businesses claim is for car expenses. You are only permitted to deduct for expenses for which you were not reimbursed. If your business is a corporation or partnership you can deduct allowable taxes through your business tax return.

But can you deduct gasoline and mileage on your taxes. This potentially includes the cost of gasoline. For example if you are a small business or self employed and you file your business tax return on schedule c along with your personal tax return you can deduct allowable business taxes on line 23.

Updated january 2020 if you use a personal vehicle for business reasons you can take many deductions for your car. Parking is also an allowable expense for this purpose but parking tickets and speeding or other tickets are not allowable expenses as breaking the law is not considered to be a part of a legitimate business expense. If you spent 2000 on gas youll deduct 1750 for business purposes.

How to file a loss after an accident if your car was damaged in an accident you can still write off the business portion of it as a loss as long as you dont include any reimbursement from your insurance company. Insurance generally you can deduct the ordinary and necessary cost of insurance as a business expense if it is for your trade business or profession. There are two allowable methods for calculating the annual deduction.

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

Deducting Business Expenses Which Expenses Are Tax Deductible

Deducting Business Expenses Which Expenses Are Tax Deductible

Standard Mileage Vs Actual Expenses Getting The Biggest Tax

Standard Mileage Vs Actual Expenses Getting The Biggest Tax

Top 10 Tax Deductions And Expenses For Small Businesses To Claim

Top 10 Tax Deductions And Expenses For Small Businesses To Claim

/dont-forget-these-monthly-business-expenses-397485_FINAL_3-4c93bb7da1e7414784b8bfd1b4d4555c.png) Business Expenses To Include In Budgeting And Taxes

Business Expenses To Include In Budgeting And Taxes

Home Business Tax Deductions Are Just One Reason Of Many That A

Home Business Tax Deductions Are Just One Reason Of Many That A

The Ultimate List Of Tax Deductions For Startups In 2020 Gusto

The Ultimate List Of Tax Deductions For Startups In 2020 Gusto

13 Business Expenses You Definitely Cannot Deduct

13 Business Expenses You Definitely Cannot Deduct

Tax Deduction Spreadsheet Template Business Tax Deductions

Tax Deduction Spreadsheet Template Business Tax Deductions

The Small Business Expense Tracker Appendix Pages 1 9 Text

The Small Business Expense Tracker Appendix Pages 1 9 Text

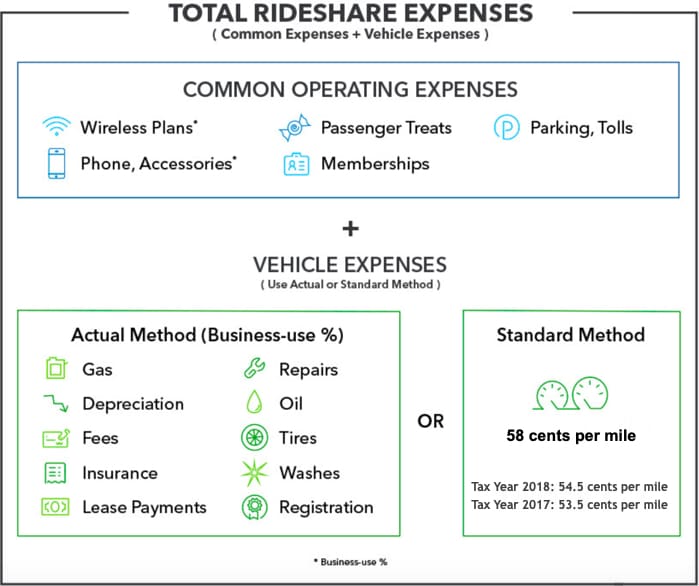

Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back