Can I Claim Income Protection Insurance As A Business Expense

Income protection insurance can either be paid by the individual out of post tax income or paid for by the company. However depending on the intent of the policy you may not.

Benefits Of Getting Insured Here S Why You Should Get A Life

Benefits Of Getting Insured Here S Why You Should Get A Life

can i claim income protection insurance as a business expense

can i claim income protection insurance as a business expense is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i claim income protection insurance as a business expense content depends on the source site. We hope you do not use it for commercial purposes.

How do i deduct car insurance as a business expense.

Can i claim income protection insurance as a business expense. If you wish to put your income protection premiums through your limited company as a trading expense it is usually wise to take out executive income protection rather than a personal plan. Claiming life insurance as a business expense there are some cases where a business can claim life insurance premiums as an expense. Keep detailed records of mileage and expenses if you need to prove your deduction later.

I have a client who has this in case she is ill and unable to work but is it allowable against tax. She i advise clients that if they wish to claim it as a business expense. Income protection insurance deductibility 31 january 2018 many people have income protection insurance policies and ask us about income protection insurance deductibility well the great news is that these policies are claimable in your personal income tax return whether you are in business or in paid employment as long as any proceeds upon making a claim are treated as taxable income.

You can apply for business expenses insurance up to 60000 per month. Which method is more cost effective comes down to the policy choice either a personal or executive plan and. To deduct car insurance as a self employed person or single member llc youll use tax form 1040 schedule c.

What is a business expense. The covered expenses are the reasonable and regular normal operating expenses of the business you own and manage including. Is income protection insurance allowable against tax.

Key man insurance can help you save on corporation tax or tax on the payout depending on how the money is used. With a personal plan tax is paid on the premiums which are paid from post tax earnings and as a result a claim will be paid tax free. Save money and claim life insurance as a business expense by running a life insurance policy through the business you can save money.

If the policy provides benefits. A company that provides group health insurance for its workers gets to write off that cost as a business expense but individuals who buy their own health insurance also can take federal income. Income protection insurance you can claim the cost of premiums you pay for insurance against the loss of your income.

You must include any payment you receive under such a policy on your tax return.

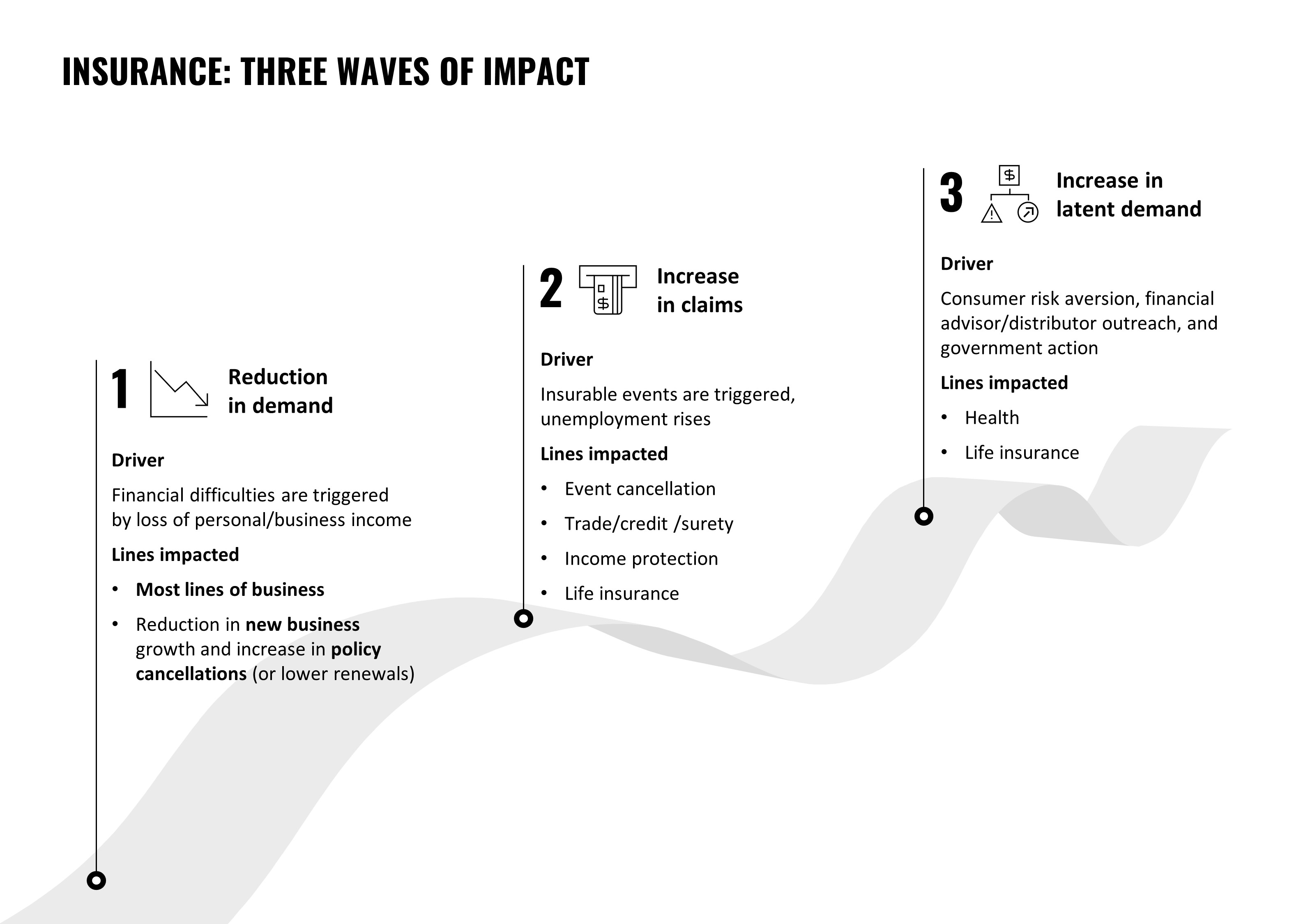

Covid 19 Considerations For Insurers In Asia

Covid 19 Considerations For Insurers In Asia

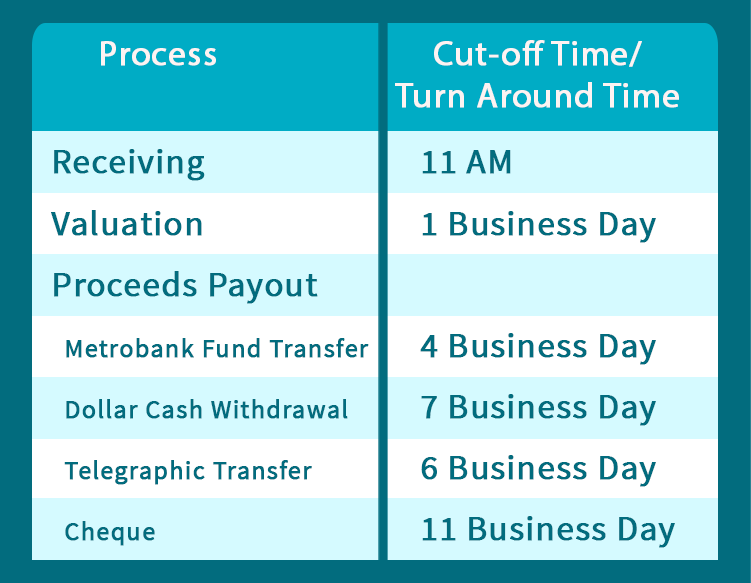

Frequently Asked Questions Axa Philippines

Frequently Asked Questions Axa Philippines

Frequently Asked Questions Axa Philippines

Frequently Asked Questions Axa Philippines

Are Life Insurance Premiums Tax Deductible

Are Life Insurance Premiums Tax Deductible

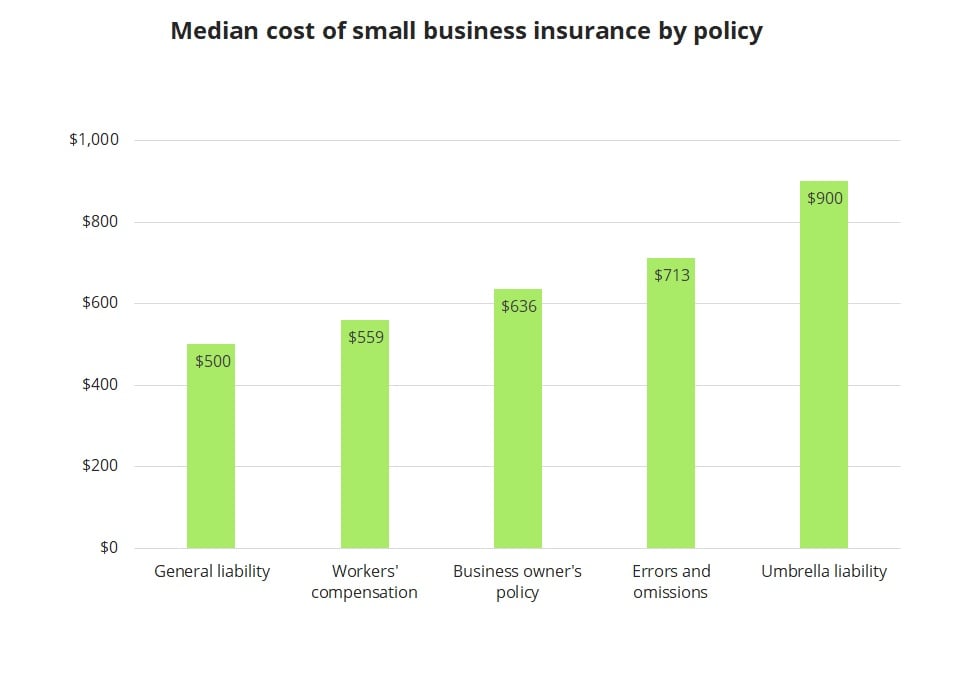

4 Types Of Insurance Everyone Needs

4 Types Of Insurance Everyone Needs

Https Www Mlcinsurance Com Au Media 95d7e9635513455e996d41b473e708e4 Ashx

Self Employment 1099s And The Paycheck Protection Program

Self Employment 1099s And The Paycheck Protection Program

Frequently Asked Questions Axa Philippines

Frequently Asked Questions Axa Philippines

:max_bytes(150000):strip_icc()/GettyImages-514211407-7890c9f9232844d1863ab073895a7c6f.jpg) Insurance Based Tax Deductions You May Be Missing

Insurance Based Tax Deductions You May Be Missing

Frequently Asked Questions Axa Philippines

Frequently Asked Questions Axa Philippines

Answers To Your Coronavirus Covid 19 Business Insurance Coverage

Answers To Your Coronavirus Covid 19 Business Insurance Coverage