Best Way To Keep Track Of Small Business Expenses

Youll need proper documentation for all your deductions. These receipts are stored in a filing cabinet and are readily available.

Expense Trackers The Top Six Tools For Small Businesses Bench

Expense Trackers The Top Six Tools For Small Businesses Bench

best way to keep track of small business expenses

best way to keep track of small business expenses is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in best way to keep track of small business expenses content depends on the source site. We hope you do not use it for commercial purposes.

This leads to messy reporting unclear results and trouble understanding what is going on.

Best way to keep track of small business expenses. Open business financial accounts store receipts properly make a spreadsheet use cloud accounting software 1. Also track whether you paid with cash check debit card or credit card. When youre looking for insights into your businesses spending dont forget to properly track what is likely one of your biggest expenses.

The more deductions you can take the lower your taxable income will be which means youll have more money in your pocket. From the start establish a system for organizing receipts and other important records. And whether the expense is a need or a want.

The paper method of small business expense tracking involves keeping copies of all receipts. Whether youre paying a full staff or youre the. It lets you create budgets and goals within the app and track your credit score.

You can also use quickbooks online to keep track of your receipts. To make the process simple consider using the same credit or debit card to make business related purchases. Using this method it is possible to keep track of business expenses through a paper log.

In this article well cover the following tips to track your business expenses. When tracking your business expenses you should keep the receipts for any business related purchases you make. The first step to start tracking your business expenses and income is to open a business bank account.

The free expense tracker for solopreneuers a well known personal expense tracker mint is also a simple tool for smaller businesses and freelancers to track where money is going. If you run a small business you might have attempted to run both your personal and business finances through one expense tracker app. Not all types of business structures are required to have separate bank accounts.

Its a crucial step that allows you to monitor the growth of your business build financial statements keep track of deductible expenses prepare tax returns and legitimize your filings. Having separate bank accounts helps keep records organized and distinct for tax purposes. Use one log for each pay period.

The irs isnt just going to take your word for it though. By keeping track of business expenses you can take the largest tax deduction youre entitled to. Open business financial accounts.

Note at the top of the worksheet how much your beginning surplus is which youll need to figure separately and subtract from that amount each expenditure.

What Do I Need To Keep Track Of Small Business Expenses Google

What Do I Need To Keep Track Of Small Business Expenses Google

Easy Ways To Track Small Business Expenses And Income Take A

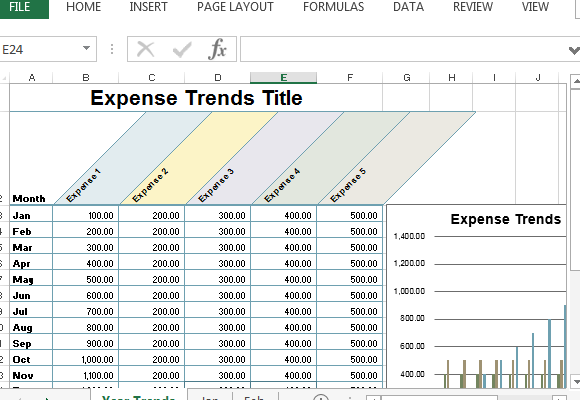

Small Business Expense Sheet For Excel

Small Business Expense Sheet For Excel

5 Types Of Strategies To Use For Seo For Small Business Small

5 Types Of Strategies To Use For Seo For Small Business Small

How To Keep Track Of Your Online Business Income And Expenses Free

How To Keep Track Of Your Online Business Income And Expenses Free

Small Business Tracking Income And Expenses Fresh Design Monthly

Free Business Income And Expense Tracker Worksheet Business

Free Business Income And Expense Tracker Worksheet Business

Small Business Expense Sheet Small Business Expense Spreadsheet