The Trade Or Business Of Performing Services As An Employee

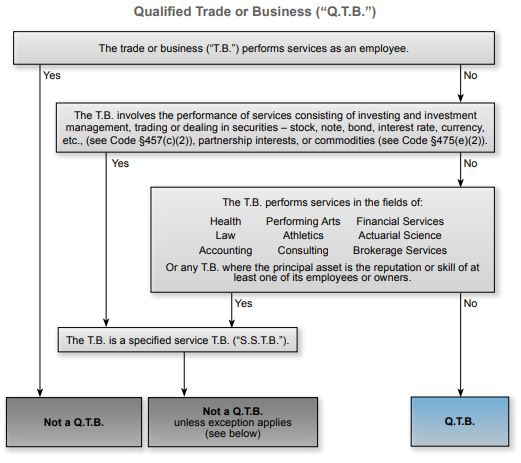

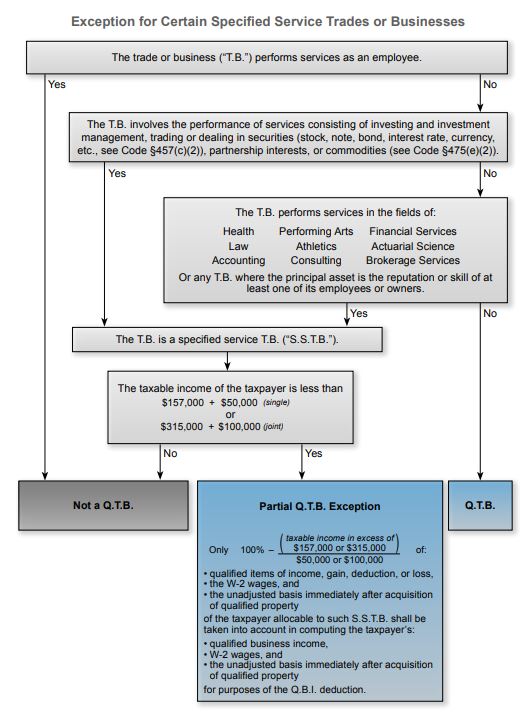

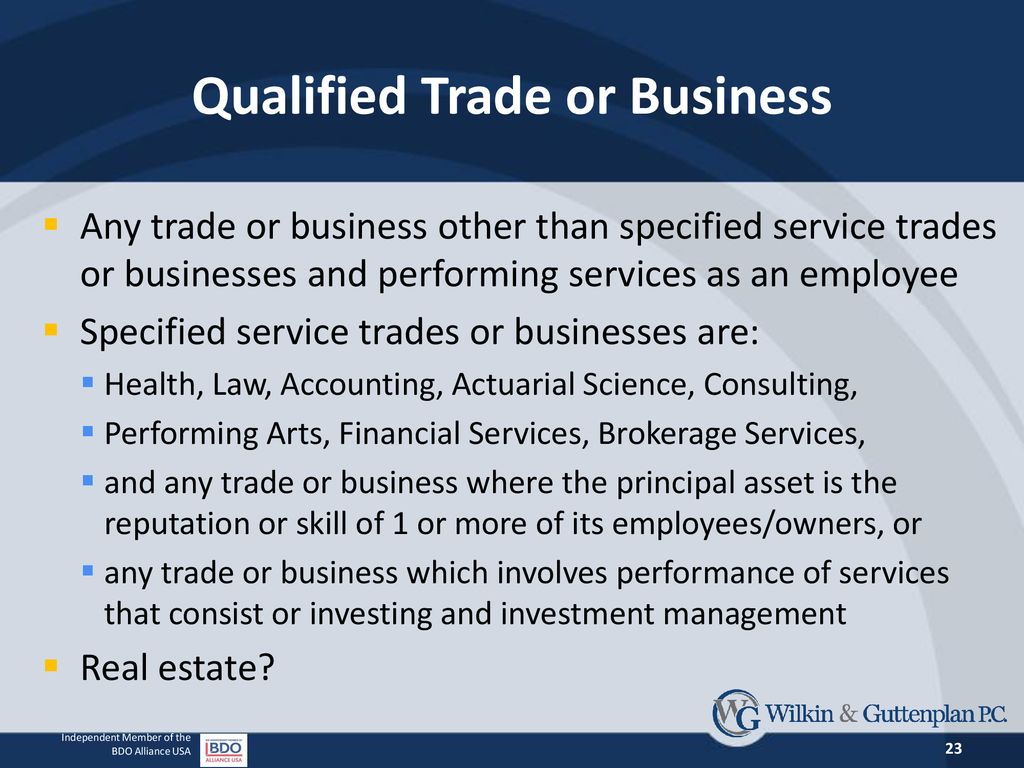

An specified service trade or business sstb is a trade or business involving the performance of services in the fields of health law accounting actuarial science performing arts consulting athletics financial services investing. Generally a specified service trade or business sstb and the trade or business of performing services as an employee are not qualified trades or businesses and income from these trades or businesses is not qbi.

Navigating Tomorrow S Tax Landscape 2020

Navigating Tomorrow S Tax Landscape 2020

the trade or business of performing services as an employee

the trade or business of performing services as an employee is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in the trade or business of performing services as an employee content depends on the source site. We hope you do not use it for commercial purposes.

1199a 1b14 provides that a.

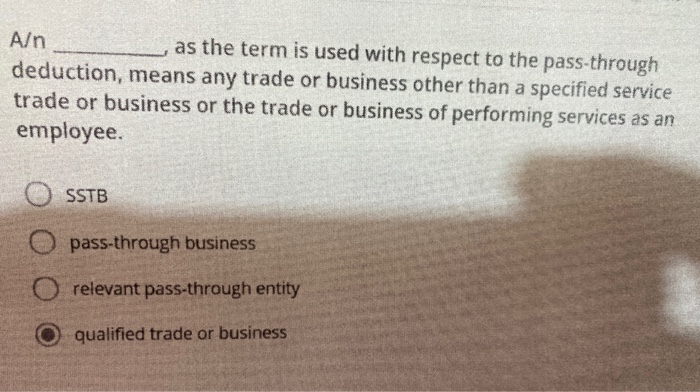

The trade or business of performing services as an employee. A qualified trade or business as defined by sec. We identified 134 cases. 199ad does not include a specified service trade or business sstb or the trade or business of performing services as an employee.

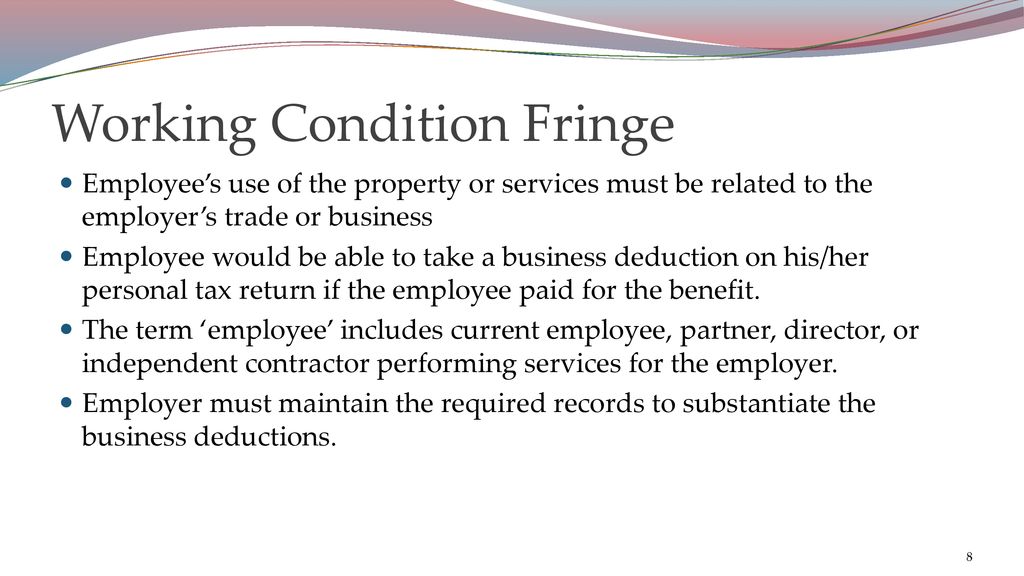

The trade or business of performing services as an employee is not a trade or business for purposes of section 199a and the regulations thereunder. Therefore no items of income gain deduction and loss from the trade or business of performing services as an employee constitute qbi within the meaning of section 199a and 1199a 3. Trade or business expenses under irc 162 and related sections summary the deductibility of trade or business expenses has long been among the ten most litigated issues in the annual report.

Services performed as an employee excluded from qualified trades or businesses. The qualified trade or business deduction for. Trade or business of performing services as an employee by jason watson cpa posted february 28 2020 the main problem here is a lot of employees might want to convert to an independent contractor status with their.

A qualified trade or business is any trade or business that is not a specified service trade or business or the trade or business of performing services as an employee sec. The trade or business of performing services as an employee is not a trade or business for purposes of section 199a. Trade or business of being an employee around the middle of august i headed out of town for a week long vacation.

I had everything wrapped up here in the office and right before i left the irs released the much anticipated proposed regulations on the irc section 199a deduction. One of the requirements of being a qualified trade or business for purposes of claiming the qbi deduction is that the taxpayer must not be in the trade or business of performing services as an employee sec.

Solved As A Term Is Used With Respect To The Pass Through

Solved As A Term Is Used With Respect To The Pass Through

Taxable And Nontaxable Compensation Ppt Download

Taxable And Nontaxable Compensation Ppt Download

Tax Reform And Its Effects On Affordable Housing Ppt Download

Tax Reform And Its Effects On Affordable Housing Ppt Download

Think Tax Reform Won T Impact Your Business Think Again Ppt

Think Tax Reform Won T Impact Your Business Think Again Ppt

Hunterdon Somerset Association Of Realtors Taxes For Realtors

Hunterdon Somerset Association Of Realtors Taxes For Realtors

Service Trading Businesses Definitions Examples Video

Service Trading Businesses Definitions Examples Video

Irs Covidreliefirs On Twitter Following Taxreform A New Tax

Irs Covidreliefirs On Twitter Following Taxreform A New Tax

Defining A Trade Or Business For Purposes Of Sec 199a Journal

Defining A Trade Or Business For Purposes Of Sec 199a Journal

What Is An Essential Employee Includes State By State Info

What Is An Essential Employee Includes State By State Info