Can A Business Owner Collect Unemployment In Pa

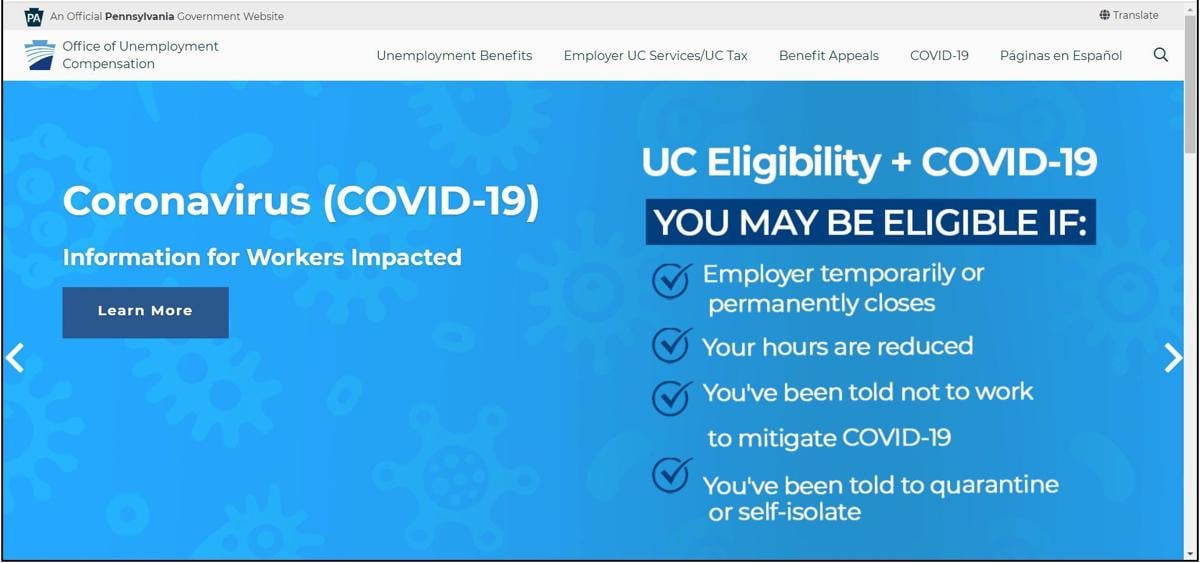

You can also reach the office of unemployment compensation via email at uchelpatpagov or via live chat which is available on weekdays from 8 am. According to the cares act self employed people affected by the covid 19 coronavirus pandemic are eligible for pandemic unemployment assistancewhile many businesses in the us.

Pa Changes Unemployment Rules To Help Its People During

Pa Changes Unemployment Rules To Help Its People During

can a business owner collect unemployment in pa

can a business owner collect unemployment in pa is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can a business owner collect unemployment in pa content depends on the source site. We hope you do not use it for commercial purposes.

Individuals serving in positions which are designated as a major non tenured policy making or advisory position.

Can a business owner collect unemployment in pa. If i am a small business owner am i eligible for unemployment benefits if i need to close or temporarily shut down my business because of covid 19. Pennsylvania unemployment compensation service centers. I am not sure why this is the case but it is the law and generally there is no.

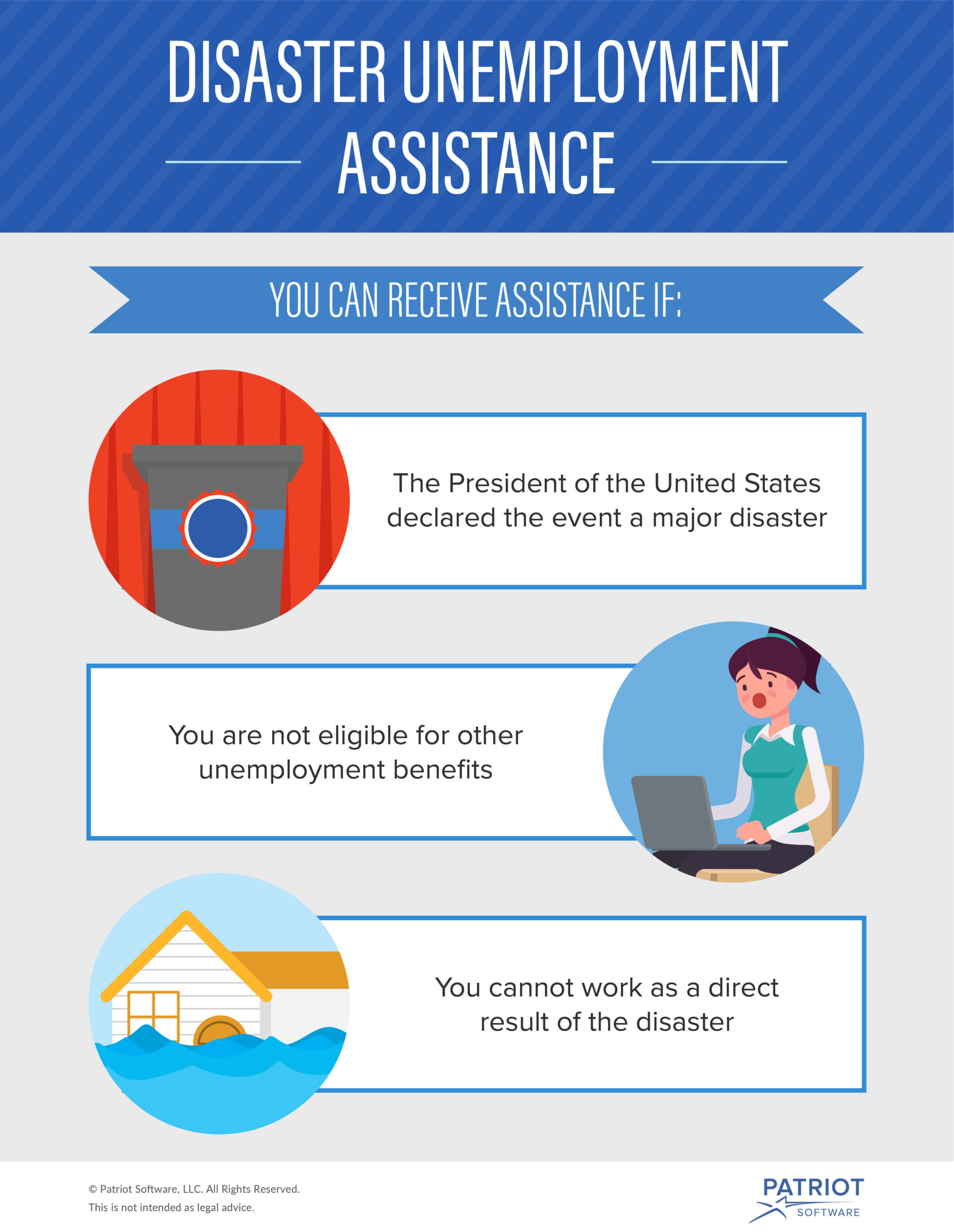

The pa uc law does not contain an exclusion for appointed officials. In a crisis natural disaster or pandemic many businesses can be forced to close because they are nonessential or are facing slowdowns and decreased income. Small business owners qualify for unemployment in the same way that other individuals do through the cares act.

If you are either a business owner of or a controlling principal in a business that fails you may not collect unemployment benefits in pennsylvania. Since march 15 pennsylvania has received 834684 new unemployment claims. Click here to read more.

Your employees if you have any are entitled to file but the rules. Are feeling the effects of forced closures and coronavirus lockdown measures small business owners and independent contractors are being hit the hardest. Pennsylvania is dealing with historically high unemployment claims because of the coronavirus.

That number is expected to escalate as more businesses respond to the pandemic. As the owner of a c corp or s corp that employees w 2 workers in the united states you have the option to file for unemployment if you have closed your business and are no longer receiving any form of compensation. If you earn your primary income from working in your own business or farm you may be eligible for pandemic unemployment assistance pua which was created as part of the federal cares act that became law on march 27 2020.

In short you must be out of work due to direct covid 19 impacts such as required business closure. In addition many types of workers typically not eligible for unemployment may receive benefits including the self employed and gig workers. However services performed by the following individuals are not covered under the uc law.

If you have closed your business and are no longer receiving any form of compensation. If you own a business and are forced to close or think you may need to close in the future you may wonder if you have any right to file for unemployment insurance.

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

Self Employed And Gig Workers Can Now Apply For Unemployment In Pa

Self Employed And Gig Workers Can Now Apply For Unemployment In Pa

When Unemployment Pays More Than The Job You Lost Whyy

When Unemployment Pays More Than The Job You Lost Whyy

What Basic Benefits Must A Company Provide Employees Paychex

What Basic Benefits Must A Company Provide Employees Paychex

A Record 3 3 Million Americans Filed For Jobless Claims As

A Record 3 3 Million Americans Filed For Jobless Claims As

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Frequently Asked Questions On Small Business Loans In Coronavirus

Frequently Asked Questions On Small Business Loans In Coronavirus

Unemployment Benefits And The Cares Act Bench Accounting

Unemployment Benefits And The Cares Act Bench Accounting

How Unemployed Workers Could Get More Than 100 Of Their Paycheck

How Unemployed Workers Could Get More Than 100 Of Their Paycheck