What Counts As A Business Expense For Taxes

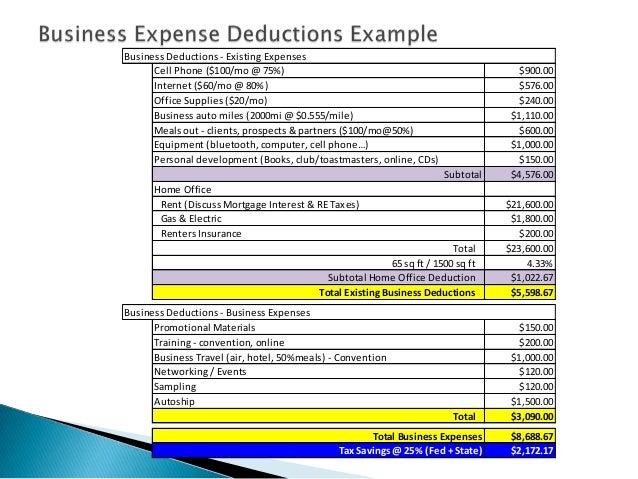

The home office deduction is available for homeowners and renters and applies to all types of homes. Insurance generally you can deduct the ordinary and necessary cost of insurance as a business expense if it is for your trade business or profession.

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

what counts as a business expense for taxes

what counts as a business expense for taxes is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in what counts as a business expense for taxes content depends on the source site. We hope you do not use it for commercial purposes.

Taxes you can deduct various federal state local and foreign taxes directly attributable to your trade or business as business expenses.

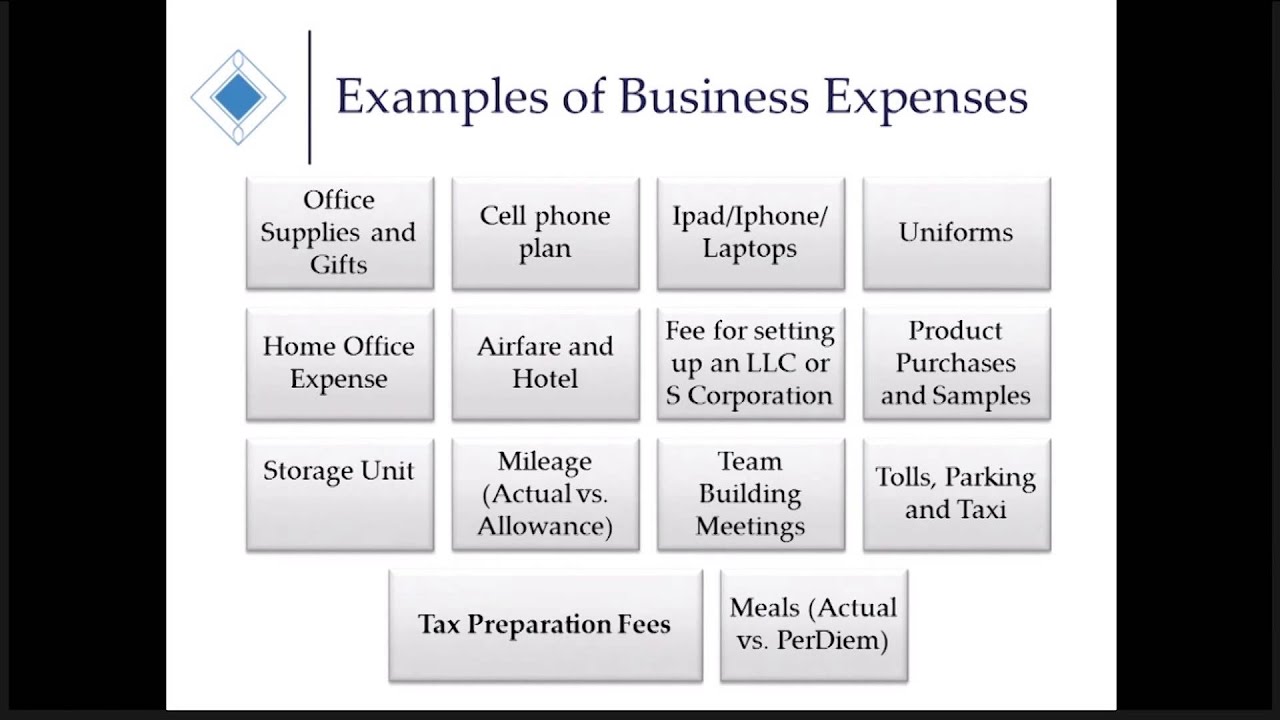

What counts as a business expense for taxes. If any office supplies expenses or equipment cost over 2500 these become depreciable assets and you must depreciate these assets. Separating personal expenses problems arise when an expense. What counts as an expense the more expenses you can claim the less tax youll pay.

Business costs for both advertising and selling are deductible but in separate places on your business tax return. For example for example if you use your website for advertising you may deduct web maintenance costs as an advertising expense. Jean murray mba phd is an experienced business writer and teacher.

The expense must be an ordinary and necessary part of carrying on your business the meal cannot be lavish or. Now because the maximum for expensing is 2500 you can take the item as a business expense in the year you buy it and start using it. Business law and taxes since 2008.

Navigating 1099 taxes is no easy task. In fact any expense that is considered ordinary and necessary for your business is likely a deductible expense. If you use part of your home for business you may be able to deduct expenses for the business use of your home.

When you earn money as an independent contractor you are taxed as a business of one in the eyes of the irs. Business expenses can include. Business meals you can generally deduct 50 of qualifying food and beverage costs.

Vehicle expenses transport costs and travel for business purposes rent paid on business premises. For business owners business expenses are generally tax deductible and keeping track of them will go a long way to reducing your tax liabilities. A lot more than you may realize.

A lot more. She has written for the balance on us. But what counts as a business expense.

When it comes time for a business owner to complete business tax. To be eligible for the deduction. Just like a company automatically withholds taxes from employees.

Tax Deductions For Your Online Business Expenses

Tax Deductions For Your Online Business Expenses

Home Office Expense Costs That Reduce Your Taxes

Home Office Expense Costs That Reduce Your Taxes

Keep Track Of Your 31 Monthly Business Expenses With This Work

Keep Track Of Your 31 Monthly Business Expenses With This Work

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

Small Business Tax Deductions Worksheet Business Tax Deductions

Small Business Tax Deductions Worksheet Business Tax Deductions

Business Expenses Worksheet For Taxes Expense Sheet Spreadsheet

Business Expenses Worksheet For Taxes Expense Sheet Spreadsheet

/dont-forget-these-monthly-business-expenses-397485_FINAL_3-4c93bb7da1e7414784b8bfd1b4d4555c.png) Business Expenses To Include In Budgeting And Taxes

Business Expenses To Include In Budgeting And Taxes

What Are Business Expenses What Expenses Can I Claim

What Are Business Expenses What Expenses Can I Claim

Business Expenses Small Business Tax And Bookkeeping 101 Webinar

Business Expenses Small Business Tax And Bookkeeping 101 Webinar

What Are Business Expenses Deductible Non Deductible Costs

What Are Business Expenses Deductible Non Deductible Costs