How Much Does A Business Owner Pay In Taxes

Income tax all businesses except partnerships must file an. Sole proprietorship partnerships and a limited liability company llc do not pay business taxes and pay taxes at the personal tax rate of the owner.

Small Business Owners Don T Like Taxes Small Business Labs

how much does a business owner pay in taxes

how much does a business owner pay in taxes is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how much does a business owner pay in taxes content depends on the source site. We hope you do not use it for commercial purposes.

Tax reform means changes in how small businesses pay taxes.

How much does a business owner pay in taxes. Small businesses with one owner pay a 133 percent tax rate on average and ones with more than one owner pay an average of 236 percent. Small businesses pay an average of 198 percent in taxes depending on the type of small business. The most recent 2017 tax reform law the tax cuts and jobs act included several key changes to how small businesses pay taxes and how much tax they pay.

Since non corporate small businesses are taxed through their owners personal tax returns how much they pay in taxes can get mixed up with the tax owed by the individual for all forms of income not just the income of the business. The list includes federal state and local taxes and taxes based on income sales property and employees. She has written for the balance on us.

The business doesnt pay its own tax because the sole proprietor business is not separate from the owner for both tax and legal purposes. Its common to hear business owners talk about getting a salary from their business but thats not actually how most business owners get paid by the business. To operate an llc in california for instance small business owners pay 800 in state taxes annually regardless of how much money the llc is making or losing.

Small business corporations known as small s corporations pay an average of 269 percent according to the small business administration. Sole proprietors and single member llc owners pay income tax based on the net income of their business. Business owners take money from their businesses as owners depending on their business ty.

The form of business you operate determines what taxes you must pay and how you pay them. You are also required to pay social security and medicare taxes on your business income. If youre in a state where you have to pay annual taxes to operate an llc then your job is to grow the business enough to offset that cost.

This means your self employment tax and your income tax which you and your business respectively will most likely pay the irs on a quarterly basis. Business law and taxes since 2008. Jean murray mba phd is an experienced business writer and teacher.

If you are the sole owner of a limited liability company llc you are a single member llc and you pay income taxes in the same way as a sole proprietor including self employment taxes explained below. The combination of income taxes and social securitymedicare taxes on your business income is called self employment taxes your payments to yourself as an owner are considered an owners draw not. What taxes does my business have to pay.

Get clear on tax obligations in this guide were outlining methods that help you set money aside for the federal taxes your business owes. But as a business owner you arent an employee so no taxes on your income from the business are taken out. The following are the five general types of business taxes.

New Tax Law Should Benefit Many Small Business Owners Jax Daily

New Tax Law Should Benefit Many Small Business Owners Jax Daily

Small Business Tax Preparation Checklist How To Prepare For Tax

Small Business Tax Preparation Checklist How To Prepare For Tax

Business Owners 2017 Year End Tax Tips Legacy Wealth Advisors

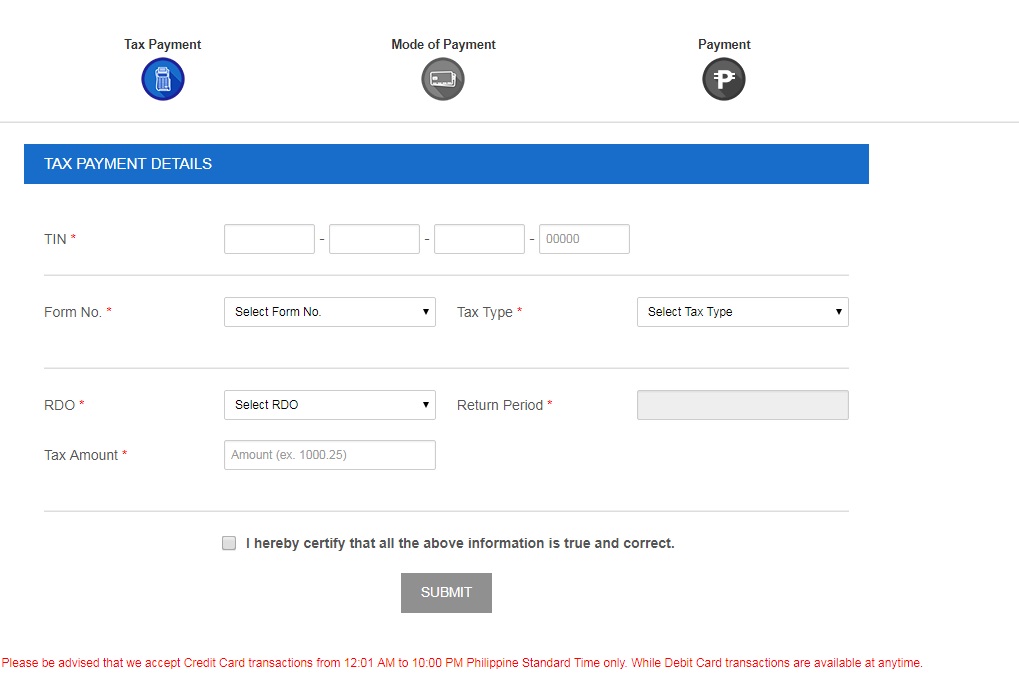

Freelancers And Small Business Owners Can Now Pay Taxes Online

Freelancers And Small Business Owners Can Now Pay Taxes Online

Small Businesses Unprepared For Tax Reform Impact Accounting Today

Small Businesses Unprepared For Tax Reform Impact Accounting Today

How Much Should You Pay Yourself A Free Calculator Small

How Much Should You Pay Yourself A Free Calculator Small

Small Business Owners Did You Know Avoid These Issues By Working

Small Business Owners Did You Know Avoid These Issues By Working

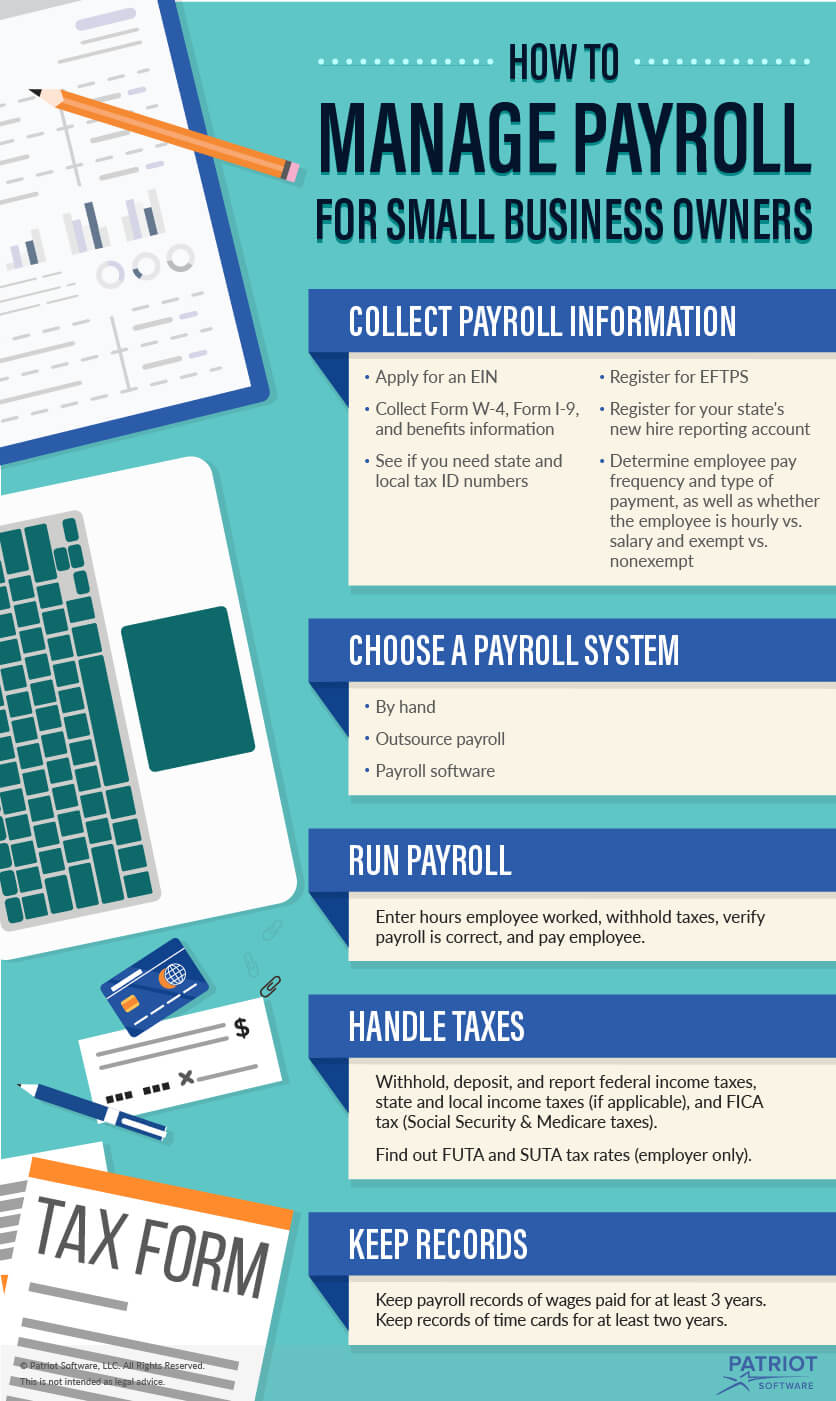

Managing Payroll For Small Business Owners

Managing Payroll For Small Business Owners

How To Pay Quarterly Taxes If You Re A Business Owner Business

What Tax Reform Means For Small Business Owners

What Tax Reform Means For Small Business Owners

5 Tax Tips For Small Business Owners To Consider In Q4 2019

5 Tax Tips For Small Business Owners To Consider In Q4 2019