Home Equity Financing For Buying Additional Property

Home loan tips for buying a second property. If your home is worth 500000.

What You Need To Know About Home Equity Loans Credit Com

What You Need To Know About Home Equity Loans Credit Com

home equity financing for buying additional property is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark home equity financing for buying additional property using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Skip navigation sign in.

Home equity financing for buying additional property. Buying a second home by remortgaging your property rather than taking out a second mortgage you can remortgage your existing property as long as you own your house outright or have built up some equity. Using equity to buy an investment property gavinmchoice. The line of credit has a draw period of 10 years plus 1 month after which you will no longer have access to borrow funds and will be required to repay the borrowed balance within a 20 year term.

Understand what equity is and find out how to access equity in your home and use it to purchase an investment property. When buying a second home. Using home equity financing for investment properties.

If using home equity financing to purchase additional property the home equity account is linked to your current home instead of the home you are buying. You could have up to 200000 in equity. Many homeowners will take out a home equity loan or line of credit in order to cover the down payment closing costs and renovation of a rental property.

This video is unavailable. With housing prices at record levels in the greater toronto area gta and interest rates near record lows its a perfect time for property owners to consider taking out a heloc or home equity loan. And you still owe 300000.

Home equity is the market value of a homeowners unencumbered interest in their real property that is the difference between the homes fair market value and the outstanding balance of all liens on the property. Its easy to work out how much equity you have in your property. How to buy investment property with a home equity loan.

Instead it could be more beneficial to use some of the equity in your primary residence to get the best possible rate on your investment property by putting down a sizable deposit. Equity is the difference between the value of your property and how much you owe on it. Given that investment property financing can be challenging to find especially on high return properties that usually carry risks that scare traditional lenders looking to creative sources of debt may be your best way to leverage into investment real estate.

A home equity line of credit heloc or a home equity loan is a great way to borrow against the equity of your home. Over time as you pay down your home loan and if the value of your property grows your equity increases. If you own it mortgage free the total value of your house is your equity.

At private wealth mortgages we often get asked can i remortgage to buy a second property or can i use equity to buy a second home in fact every year thousands of people in the uk decide to buy a second home either as an investment or a place they can use as a holiday home. Another way home equity financing is often used is to fund investment properties.

Home Equity Line Of Credit Finder Finder Com

Home Equity Line Of Credit Finder Finder Com

How To Buy A Second Home Bankrate Com

How To Buy A Second Home Bankrate Com

What To Know About A Home Equity Loan Esl Federal Credit Union

What Is A Home Equity Loan Bankrate

What Is A Home Equity Loan Bankrate

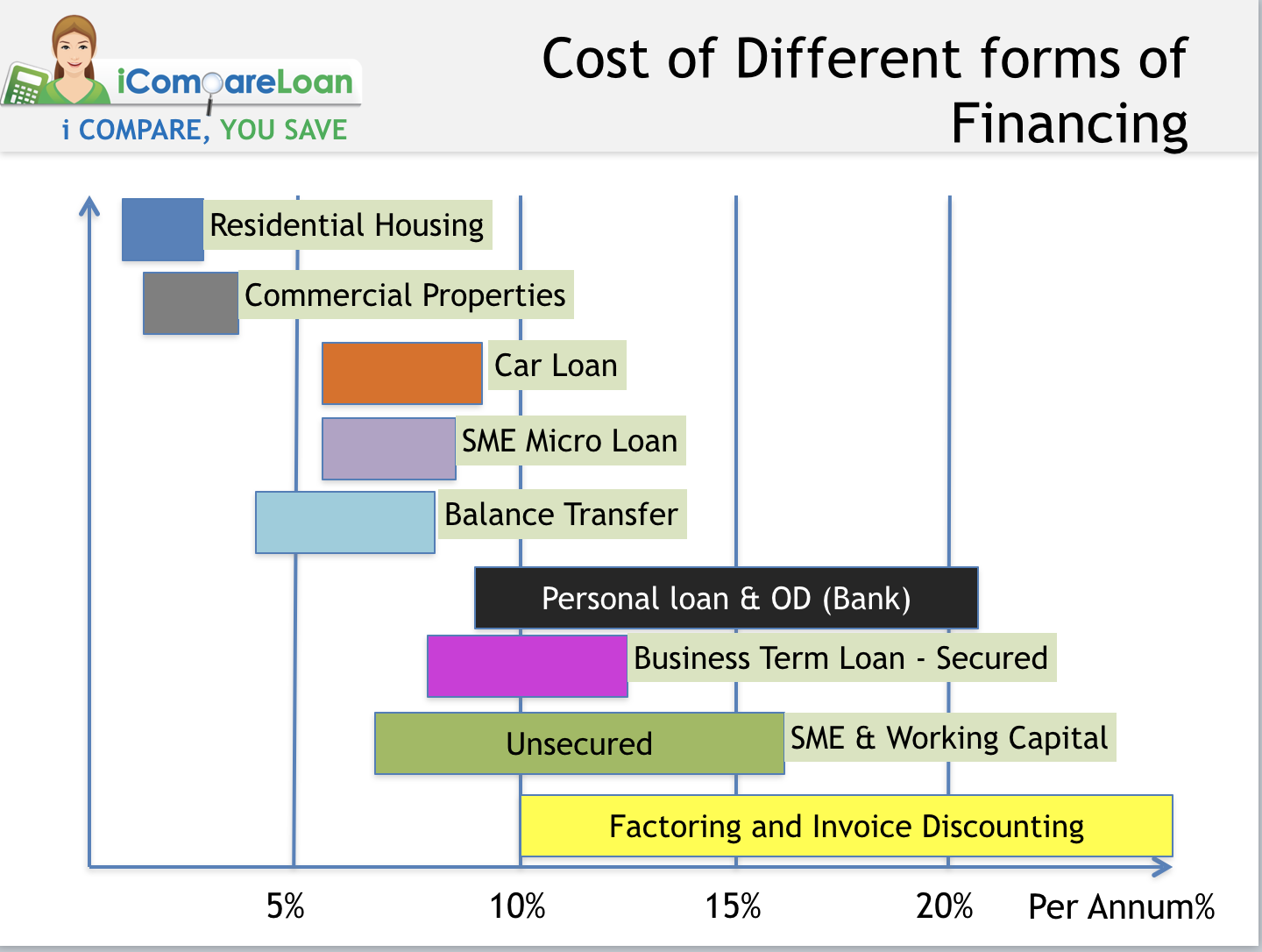

Types Of Loans In Singapore Different Financing Costs And

Types Of Loans In Singapore Different Financing Costs And

How To Refinance An Investment Property Zillow

How To Refinance An Investment Property Zillow

Home Equity Loans With Bad Or Poor Credit Low Credit Score

Home Equity Loans With Bad Or Poor Credit Low Credit Score

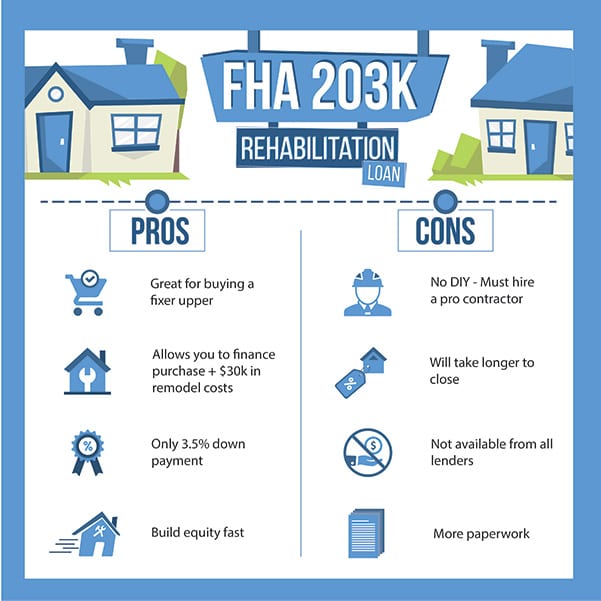

203k Loan Fha 2019 Home Renovation Mortgage Benefits

203k Loan Fha 2019 Home Renovation Mortgage Benefits

/GettyImages-511327652-5bf0578946e0fb0051ac6acc.jpg) Home Equity What It Is And How To Use It

Home Equity What It Is And How To Use It

Home Equity Loan Financing Buy Additional Property Wells

Home Equity Loan Financing Buy Additional Property Wells