Difference Between Long Term Finance And Short Term Finance

The borrower takes the lump sum amount and agrees to return the amount along with interest thereupon. Difference between short term and long term financing corporate finance management notes.

What Is The Difference Between Short Term And Long Term

difference between long term finance and short term finance is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark difference between long term finance and short term finance using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

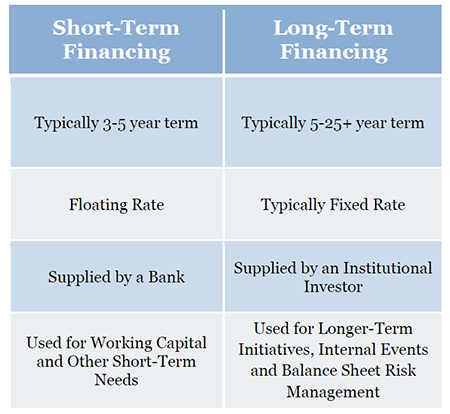

Short term financing is normally for less than a year and long term could even be for 10 15 or even 20 years.

Difference between long term finance and short term finance. Long term and short term. Thus your primary decision will involve making a choice between long term financing and short term financing. What is the difference between short term finance and long term finance.

Long term and short term loans serve different purposes. The time period is simple to understand. They have different interest rates repayment terms collateral requirements and credit standards.

The most important difference between the two types of financing is the time period the purpose and the cost of financing. The difference between the short and long carbon cycle is that the short cycle emphasizes the interaction between the biosphere and atmosphere while the long cycle emphasizes the formation and destruction of fossil fuels. Short term financing refers to business or personal loans that have a shorter than average time span for repaying the loan typically one year or less.

An important principle to keep in mind is that the term length of your financing should match up with the term length of your financial needs. The term loan is a type of financing given by financial institutions such as commercial banks development banks and special institutions for lending money. Not only does the difference between long term and short term financing concern the underlying payment terms it also dictates how liabilities are carried on the books and how taxes are paid.

Short term vs long term financing. The following article provides an explanation of what short term and long term financing are with examples and outlines the differences between the two forms of financing. Long and short term financing instruments of long term financing the long term financial requirement means the finance needed to acquire land and building for business concern purchase of plant and machinery and other fixed expenditure.

Short term financing also called current liabilities are debts that can be paid off within the current operating cycle. One type is used to finance fluctuations in a companys cash flow cycle while the other is used to acquire fixed assets. Normally it is of two types.

Long term and short term financing are different to each other mainly because of the time period for which the finance is provided or the debtloan repayment period.

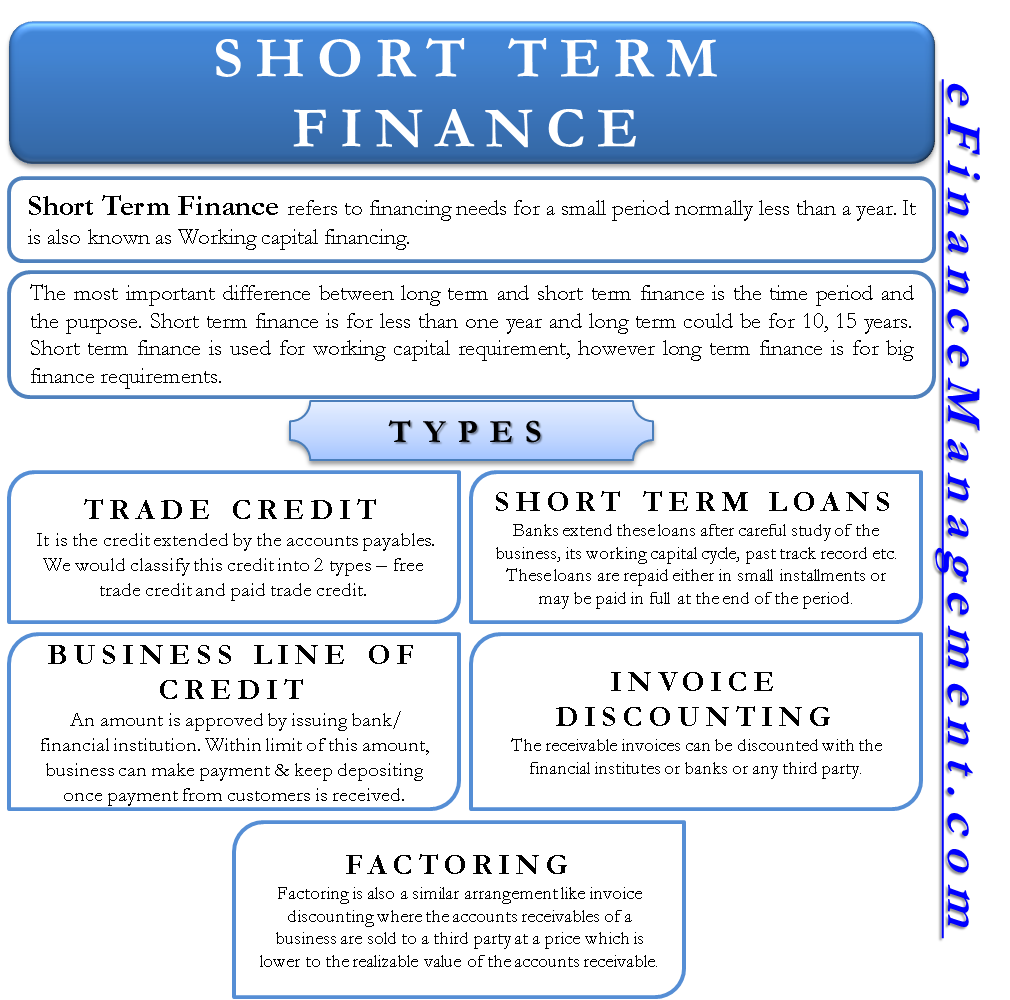

Short Term Finance Types Sources Vs Long Term

Short Term Finance Types Sources Vs Long Term

Here S How Short Term Financing Can Help Increase Profits Of

Here S How Short Term Financing Can Help Increase Profits Of

Class 11 Business Studies Sources Of Business Finance

Class 11 Business Studies Sources Of Business Finance

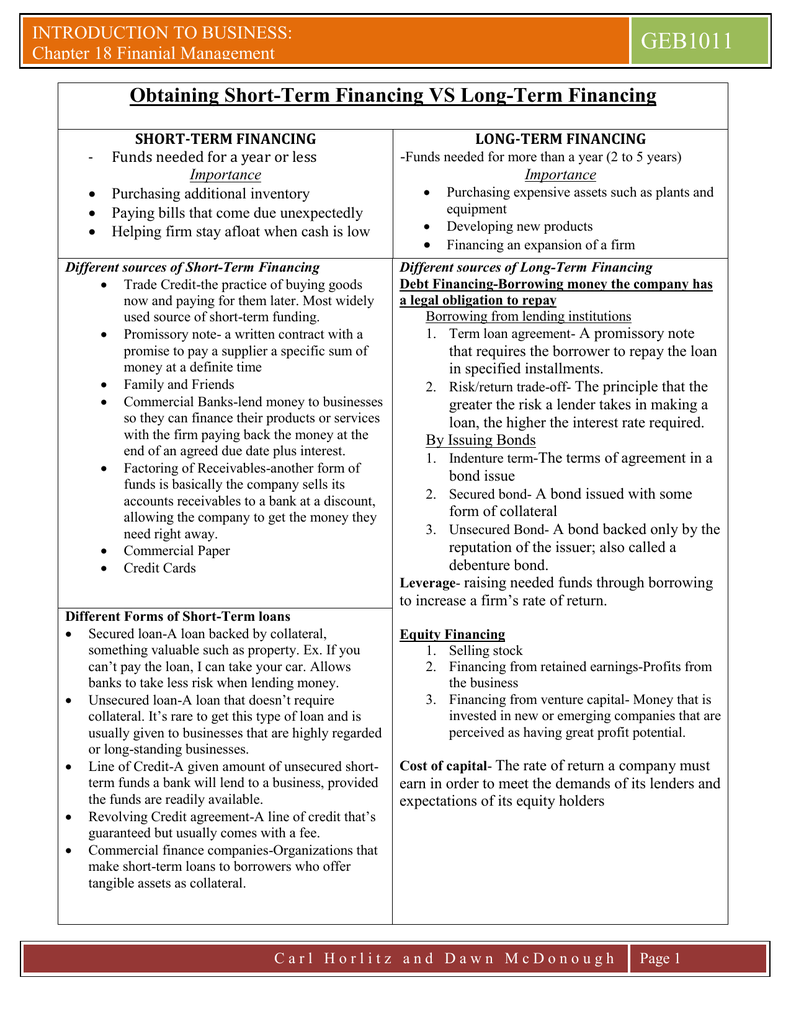

Pin By Accounting Taxation On Accounting Financial

Pin By Accounting Taxation On Accounting Financial

Sources Of Finance Long Term Short Term

Sources Of Finance Long Term Short Term

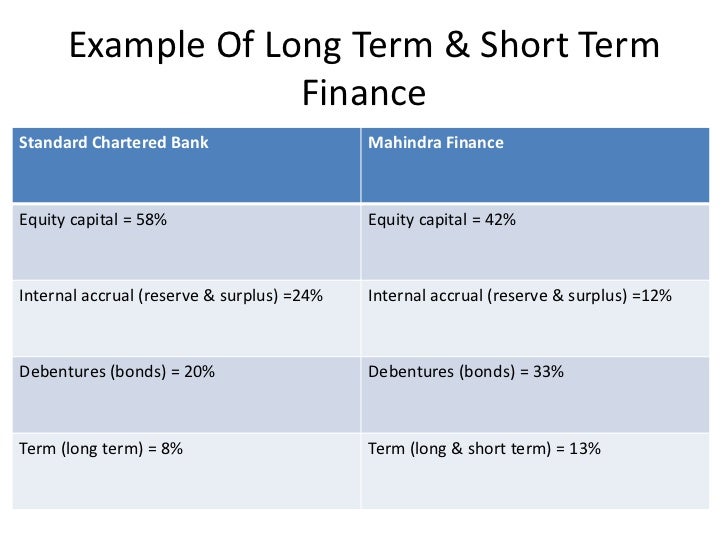

Geb1011 Obtaining Short Term Financing Vs Long Term

Geb1011 Obtaining Short Term Financing Vs Long Term

Chapter 6 7 8 Short Term Financing Introduction Long Term

Chapter 6 7 8 Short Term Financing Introduction Long Term

Short Vs Long Term Personal Loans Fundstiger Fast Loans

Short Vs Long Term Personal Loans Fundstiger Fast Loans

Accounting For Management Decisions Ppt Video Online Download

Accounting For Management Decisions Ppt Video Online Download