How To Calculate Payback Period In Finance

The main advantage of the payback period for evaluating projects is its simplicity. Experiment with other investment calculators or explore other calculators addressing finance math fitness health and many more.

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review

how to calculate payback period in finance is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark how to calculate payback period in finance using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

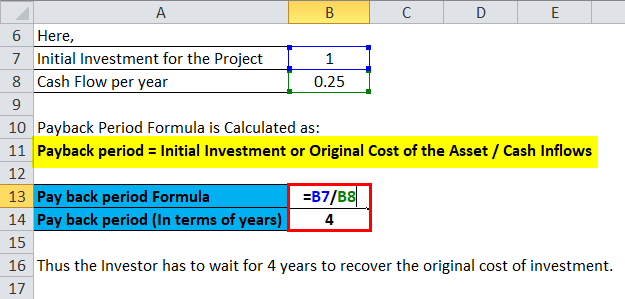

The payback period formula is used to determine the length of time it will take to recoup the initial amount invested on a project or investment.

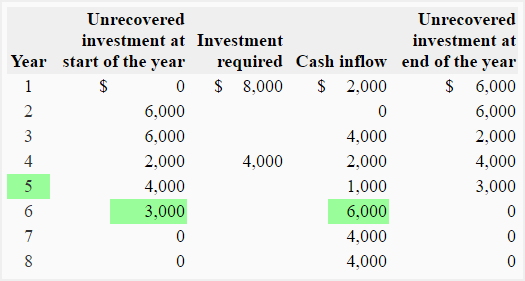

How to calculate payback period in finance. The payback period is the expected number of years it will take for a company to recoup the cash it invested in a project. The payback period of a project is defined as the number of years it takes for the project to recover its original investment. The payback period is the cost of the investment divided by the annual cash flow.

The payback period is the time required to earn back the amount invested in an asset from its net cash flows. It is a simple way to evaluate the risk associated with a proposed project. An investment with a shorter payback period is considered to be better since the investors initial outla.

Lets assume that a company invests cash of 400000 in more efficient equipment. The payback period shows how long it takes for a business to recoup its investment. What is the payback period.

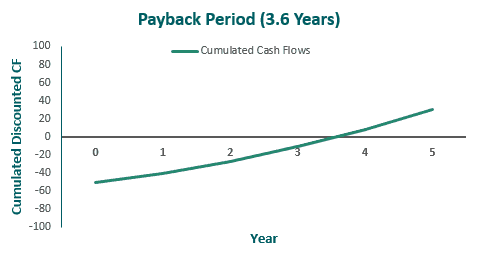

Conversely the longer the payback the less desirable it is. How to calculate the payback period and the discounted payback period on excel duration. The cash savings from the new equipment is expected to be 100000 per year for 10 years.

You can use it when analyzing different possibilities to invest your money and combine it with other tools such as the net present value or internal rate of return metrics. Free calculator to find payback period discounted payback period and average return of either steady or irregular cash flows or to learn more about payback period discount rate and cash flow. The payback period is the amount of time needed to recover an initial investment outlay.

This payback period calculator is a tool that lets you estimate the number of years required to break even from an initial investment. How to calculate payback period formula in 6 min. The shorter the payback the more desirable the investment.

This type of analysis allows firms to compare alternative investment opportunities and decide on a project that returns its investment in the shortest time if that criteria is important to them. Basic tutorial lesson review mbabullshitdotcom. A few disadvantages of using this method are that it does not consider the time value of money and it does not assess the risk involved with each project.

The payback period formula is used for quick calculations and is generally not considered an end all for evaluating whether to invest in a particular situation. Lets take a simple example to understand how payback period is calculated. For example if solar panels cost 5000 to install and the savings are 100 each month it would take 42 years to reach the payback period.

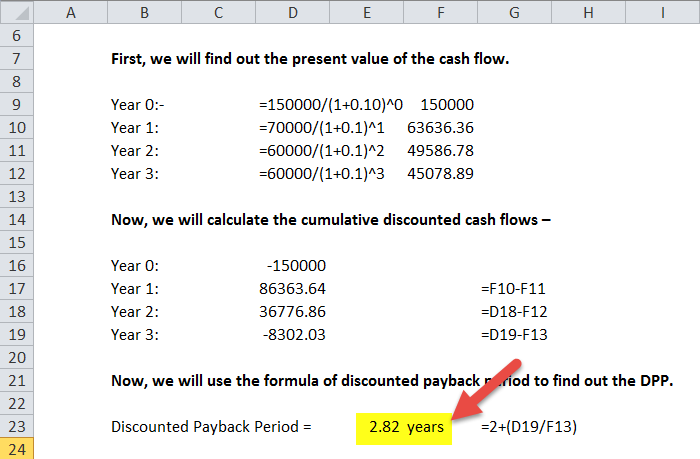

Discounted Payback Period Formula Calculator With Excel

Discounted Payback Period Formula Calculator With Excel

Payback Period Formula Calculator Excel Template

Payback Period Formula Calculator Excel Template

How To Calculate The Payback Period With Excel

Payback Period Business Tutor2u

Payback Period Business Tutor2u

Payback Method Formula Example Explanation Advantages

Payback Method Formula Example Explanation Advantages

Payback Period Formula Calculator With Excel Template

Payback Period Formula Calculator With Excel Template

Calculating Payback Period And Average Rate Of Return

Payback Period Formula Calculator Excel Template

Payback Period Formula Calculator Excel Template

Payback Period Method Double Entry Bookkeeping

Payback Period Method Double Entry Bookkeeping

All About Payback Period 12manage

All About Payback Period 12manage

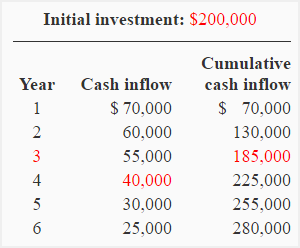

Exercise 8 Computation Of Payback Period Uneven Cash

Exercise 8 Computation Of Payback Period Uneven Cash

0 Response to "How To Calculate Payback Period In Finance"

Post a Comment