As A Form Of Financing Equity Capital

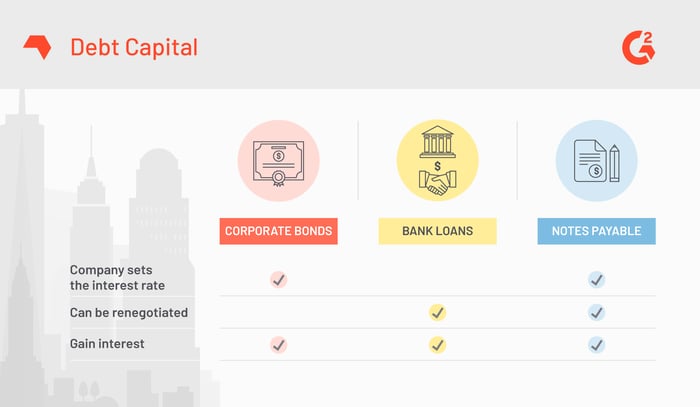

But experts suggest that the best strategy is to combine equity financing with other types including the entrepreneurs own funds and debt financing in order to spread the businesss risks and ensure that enough options will be available for later financing needs. With debt this is the interest expense a company pays on its debt.

External Sources Of Finance Capital

External Sources Of Finance Capital

as a form of financing equity capital is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark as a form of financing equity capital using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Market signal venture capital return on inves.

As a form of financing equity capital. When financing a company cost is the measurable cost of obtaining capital. Definition of equity capital. With equity the cost of capital refers to the claim on earnings provided to shareholders for their ownership stake in the business.

Invested money that in contrast to debt capital. Sole proprietorships must rely on their personal assets for capital. By selling shares they sell ownership in their company in.

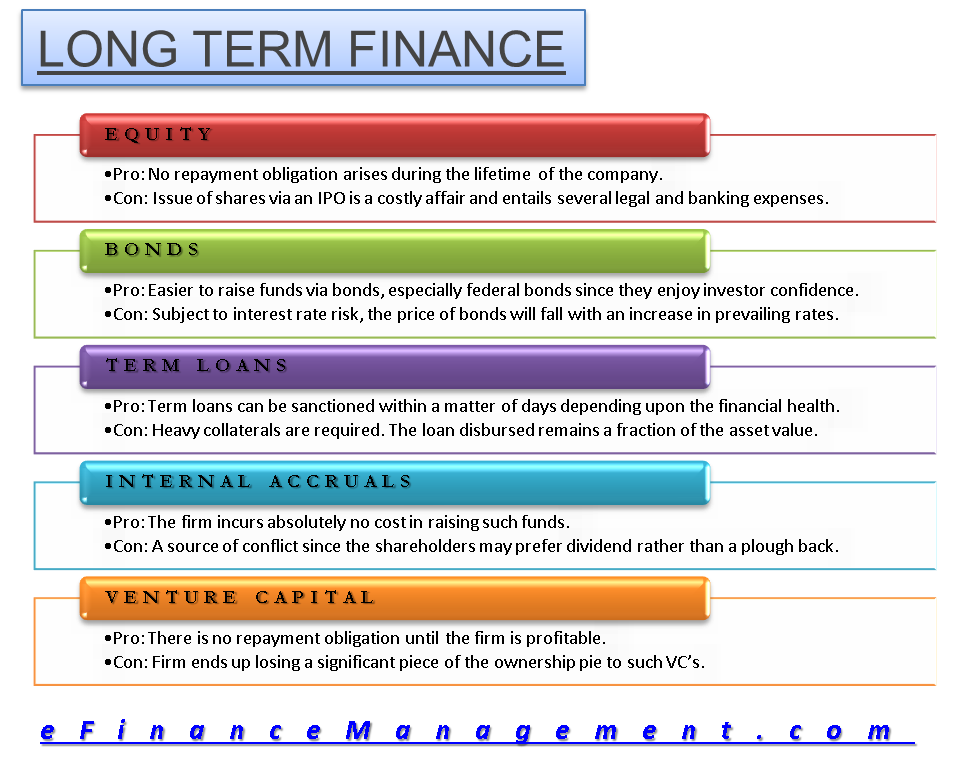

Equity financing is the process of raising capital through the sale of shares. Also called equity financing or share capital. When a business owner uses equity financing they are selling part of their ownership interest in their business.

This makes up for the lack of capital necessary to hire sufficient employees to do the job well and let them work an ordinary forty hour workweek. Overall equity financing can be an attractive option for many small businesses. Financing cost stated value.

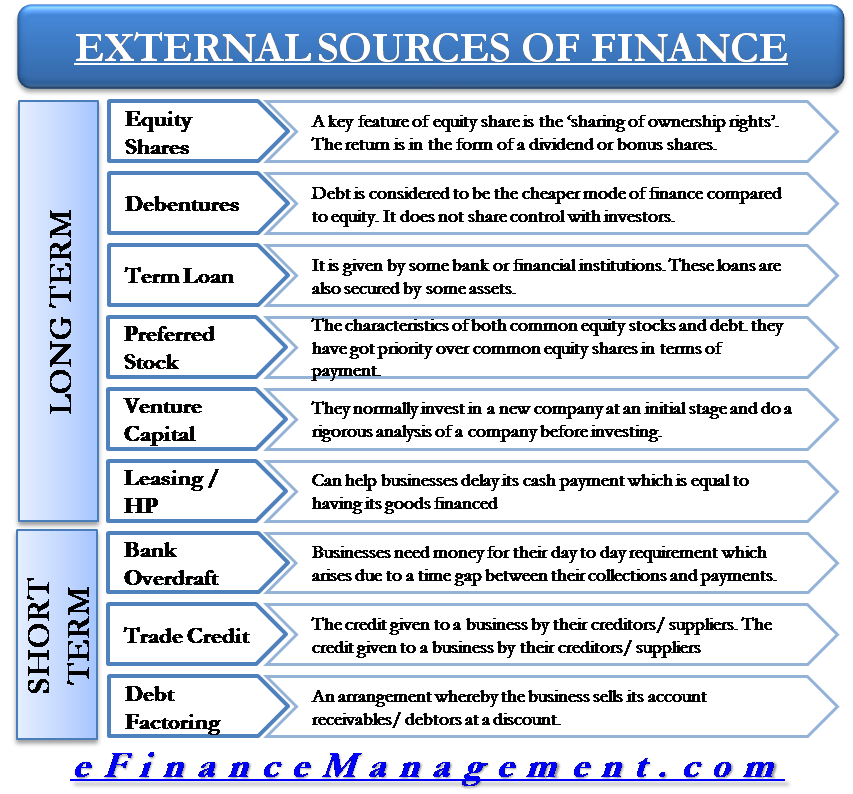

Risk asset institutional f. Companies raise money because they might have a short term need to pay bills or they might have a long term goal and require funds to invest in their growth. Equity financing is a method of gathering funds from investors to finance your business.

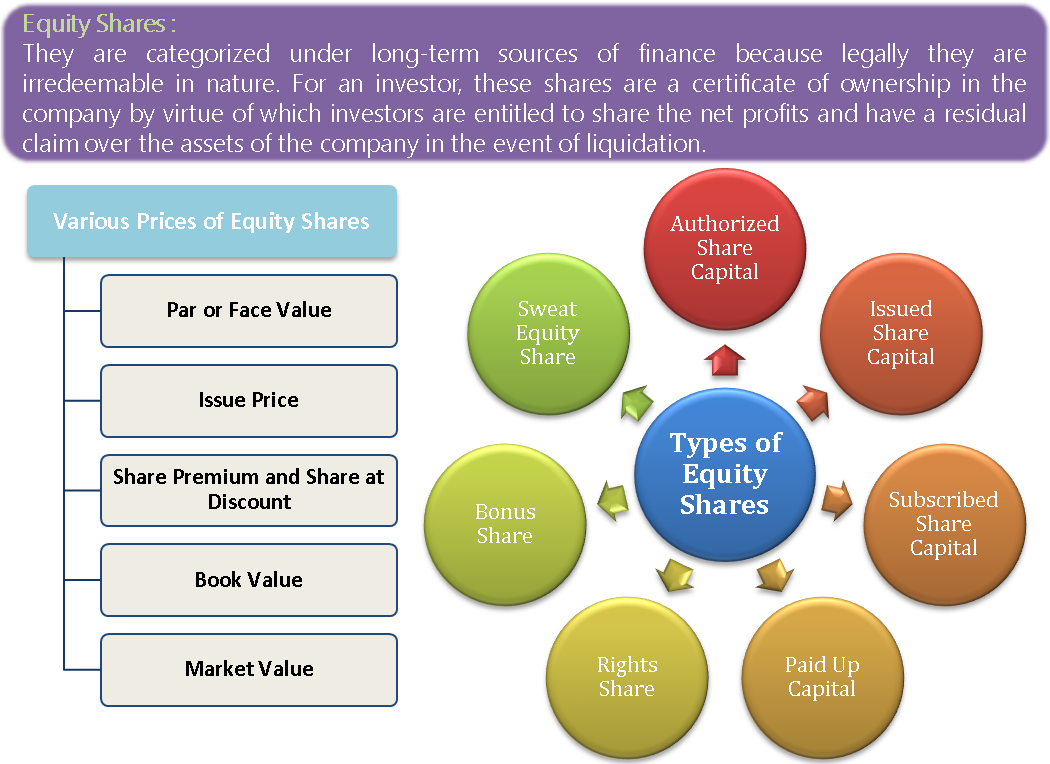

Equity financing involves raising money by offering portions of your company called shares to investors. If they cannot then sell assets raise money mortgage personal property risk personal loss then they can either form a partnership or form a corporation and sell stock partnerships the partner brought in is not required to invest money may be there for expertise but. There is also a form of capital known as sweat equity which is when an owner and sometimes key employees bootstraps operations by putting in long hours at a low rate of pay per hour.

Long Term Finance Equity Bonds Term Loans Internal

Long Term Finance Equity Bonds Term Loans Internal

As A Form Of Financing Equity Capital A Has A Maturity Date

As A Form Of Financing Equity Capital A Has A Maturity Date

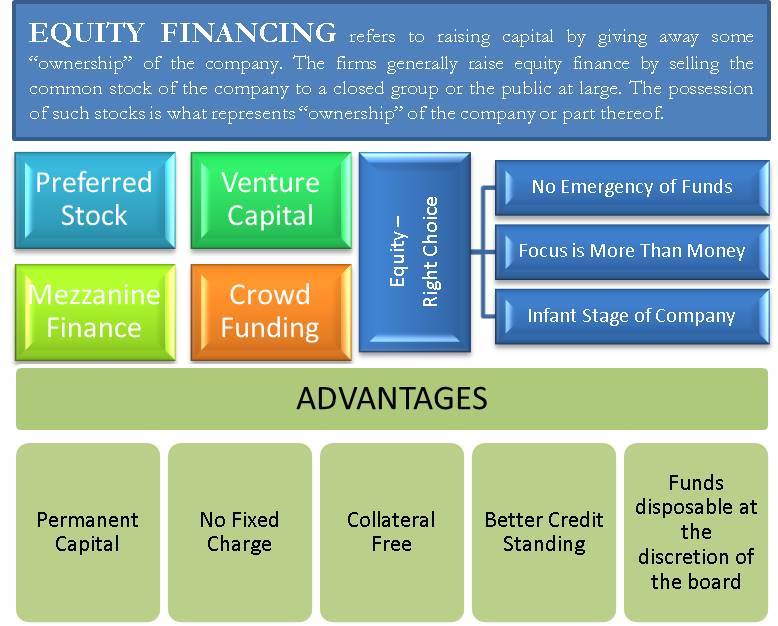

Equity Financing Defined When Is It Preferred Types

Equity Financing Defined When Is It Preferred Types

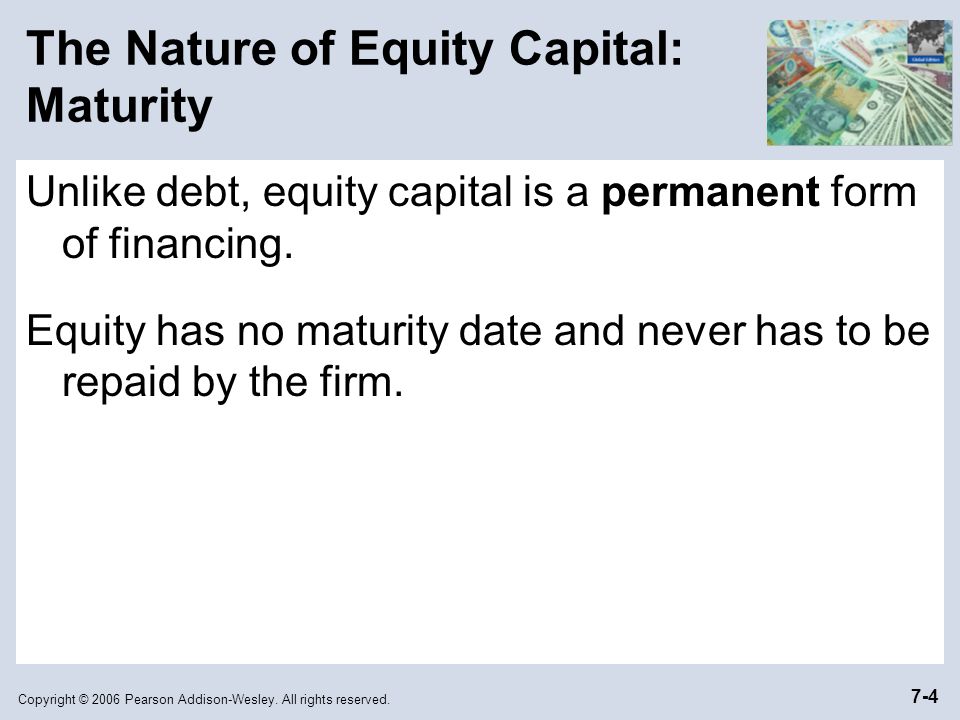

The Nature Of Equity Capital Voice In Management Ppt Download

The Nature Of Equity Capital Voice In Management Ppt Download

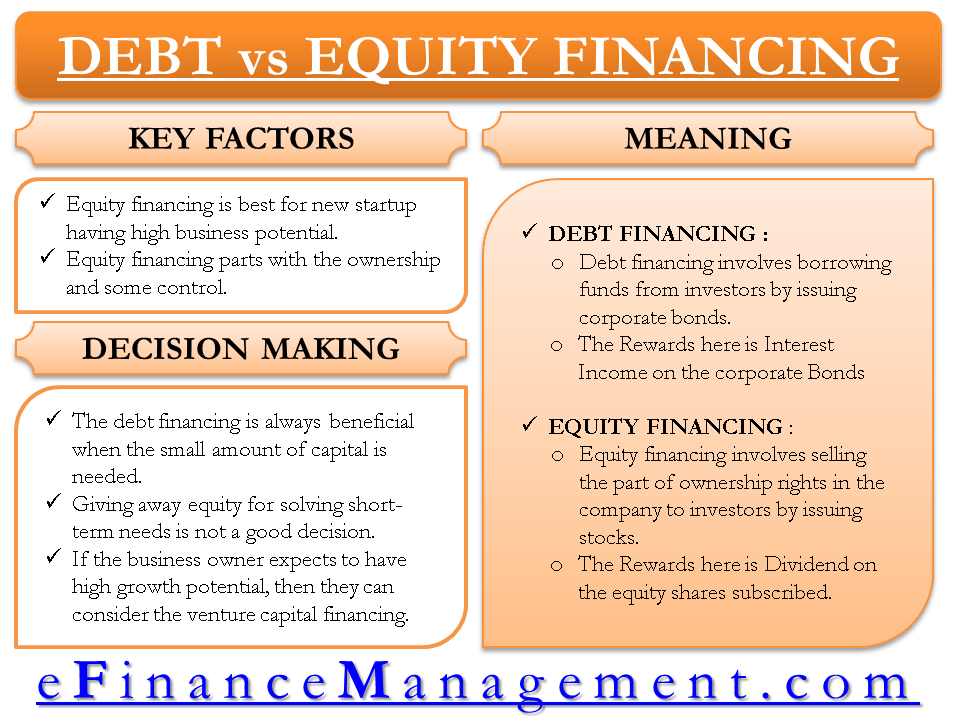

Debt Vs Equity Financing Efinancemanagement Com

Debt Vs Equity Financing Efinancemanagement Com

Main Sources Of Equity And Debt Research Paper Service

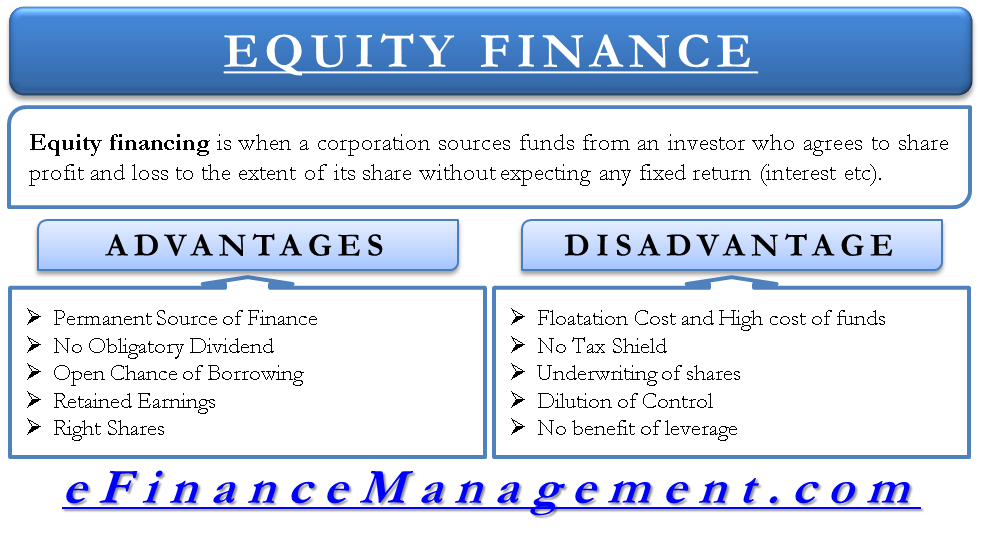

Benefits And Disadvantages Of Equity Finance

Benefits And Disadvantages Of Equity Finance

Dr Ebi Ofrey Business Advisor Series Financing Options

Dr Ebi Ofrey Business Advisor Series Financing Options

Venture Debt A Capital Idea For Startups Kauffman Fellows