How Do Finance Companies Differ From Commercial Banks

Finance companies make a profit by borrowing money at a rate lower than the rate at which they lend. The primary function of finance companies is to make loans to individuals and corporations.

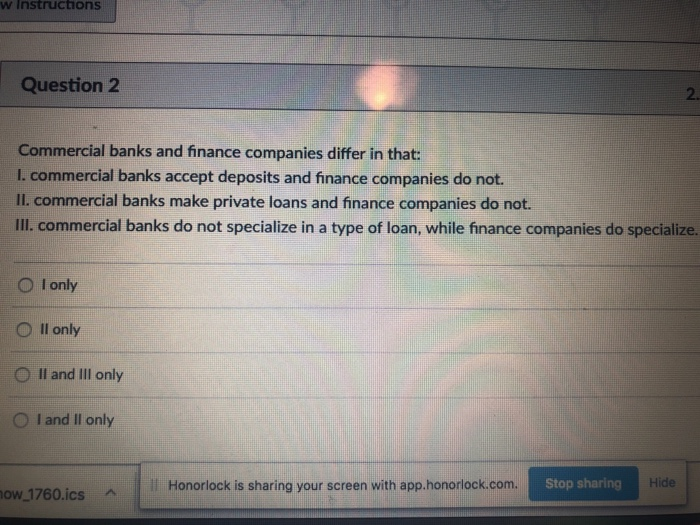

Solved W Instructhons Question 2 2 Commercial Banks And

Solved W Instructhons Question 2 2 Commercial Banks And

how do finance companies differ from commercial banks is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark how do finance companies differ from commercial banks using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Donald simonson reviews the shift of a large share of the credit market to commercial financial companies during the last decade and asks whether the banks loss of market share resulted in a loss of efficiency.

How do finance companies differ from commercial banks. It was repealed over six decades later in 1999. Although they do have some similarities their operations are based on different models that lead to some notable contrasts between them. Unlike a bank or credit union finance companies do not accept deposits.

How do finance companies differ from commercial banks. Some offer a big range of products some specialize says chris kukla senior counsel for government affairs with the center for responsible lending. Difference between banks and financial institutions is described below.

What are consumer finance companies. Residential and commercial mortgages have become a major component in finance company portfolios since finance companies are not subject to as extensive regulations as are banks they are often willing to issue mortgages to riskier borrowers than commercial banks for higher interest rates and fees. Since then major banking institutions have been permitted to operate in the investment and commercial arenas.

How do these risks differ for a finance company versus a commercial bank. Both banks and insurance companies are financial institutions but they dont have as much in common as you might think. However while there are some blended institutions most us.

They just loan money sometimes with fixed terms and sometimes not. Banks have chosen to remain as either investment banks or commercial banks. In financial economics a financial institution acts as an agent that provides financial services for its clients.

Reasons for this include the following. This is similar to a commercial bank with the primary difference being the source of funds principally deposits for a bank and money and capital market borrowing for a finance company. In every year from 1983 to 1992 business credit at commercial banks.

Finance companies do not accept deposits but borrow short and long term debt such as commercial paper and bonds to finance the loans. There are a number of finance sources competing for your business including banks and non bank financial companies also known as nbfcs. Banks and finance companies are both considered financial institutions meaning they accept money from customers or investors then use that capital to make loans.

Banks and insurance companies are both. What is the primary function of finance companies. Financial institutions generally fall under financial regula.

What Is The Difference Between Banks And Financial

What Is The Difference Between Banks And Financial

Solved What Are The Differences Between Depository And No

Solved What Are The Differences Between Depository And No

Lecture Notes Lecture Chapter 6 Finance Companies Rn

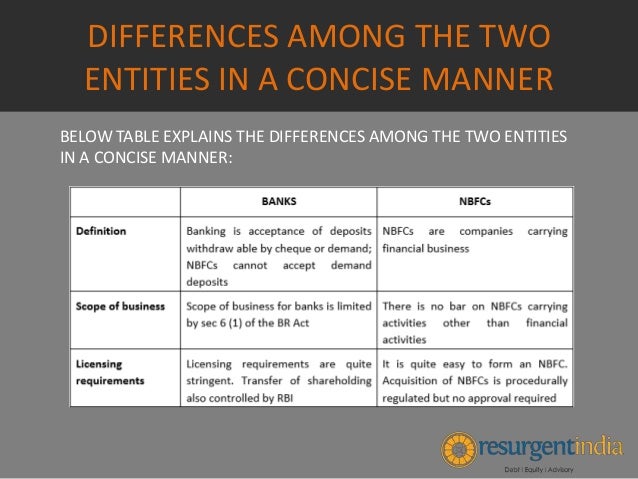

Non Banking Financing Companies Differences Between

Non Banking Financing Companies Differences Between

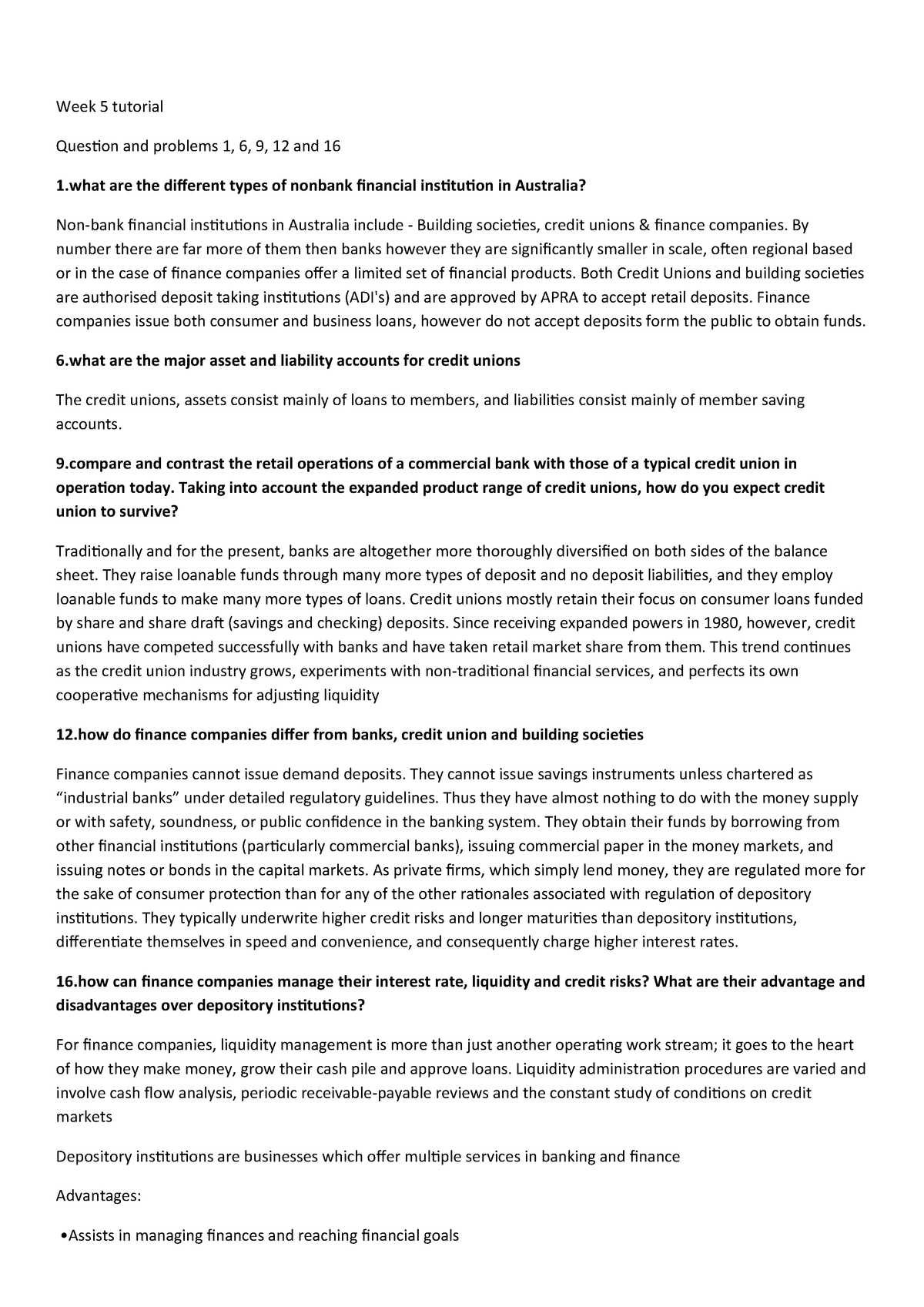

Fin111 Tutorial Fin 111 Introductory Principles Of Finance

Fin111 Tutorial Fin 111 Introductory Principles Of Finance

Chapter 22 Finance Companies Differ From Commercial Banks

Chapter 22 Finance Companies Differ From Commercial Banks

Non Banking Financing Companies Differences Between

Non Banking Financing Companies Differences Between

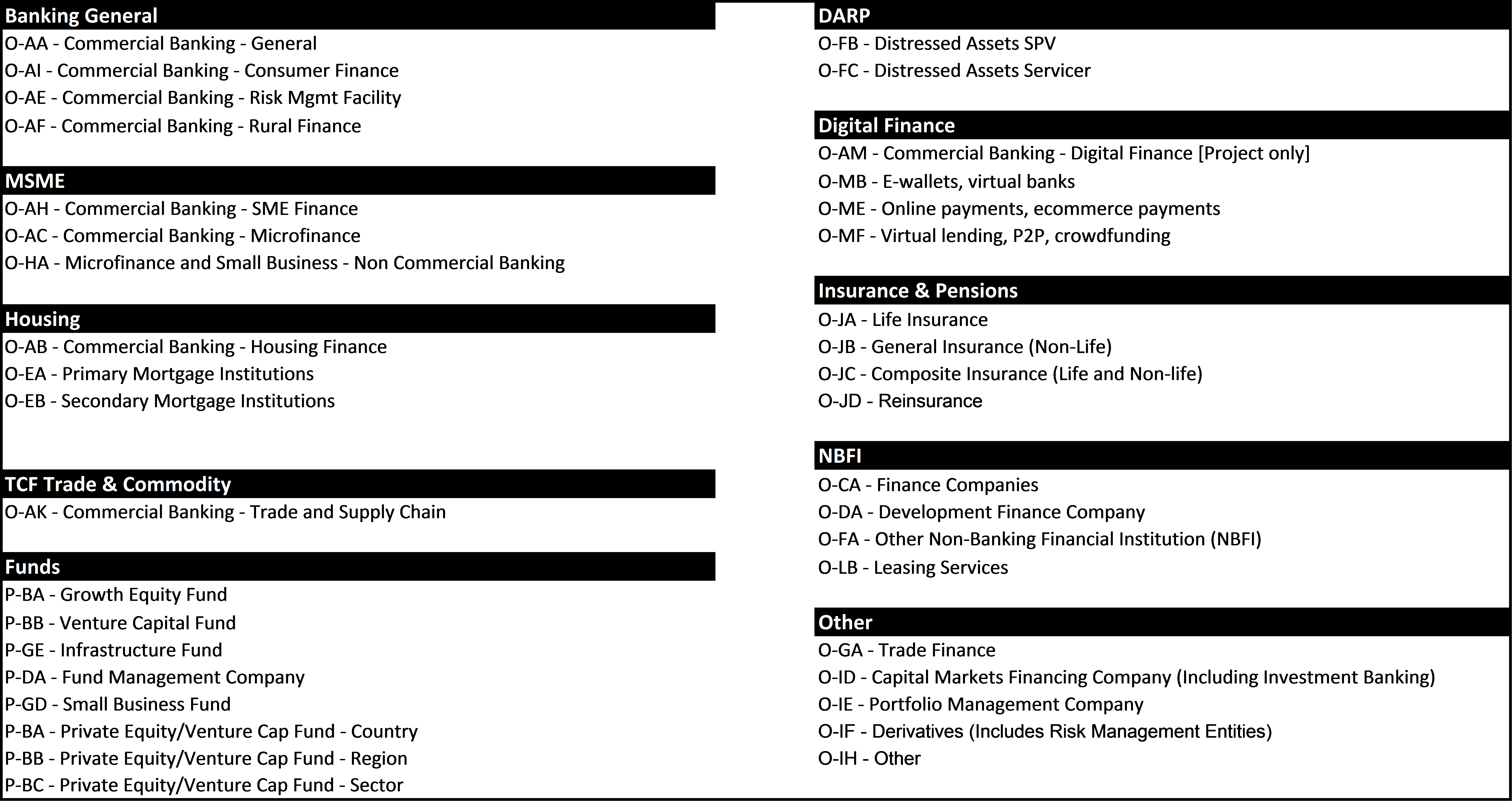

How To Analyze Banks And Non Banking Finance Companies Nbfc

Payments Banks And Small Finance Banks

Functional Difference Of Bank And Non Bank

Functional Difference Of Bank And Non Bank