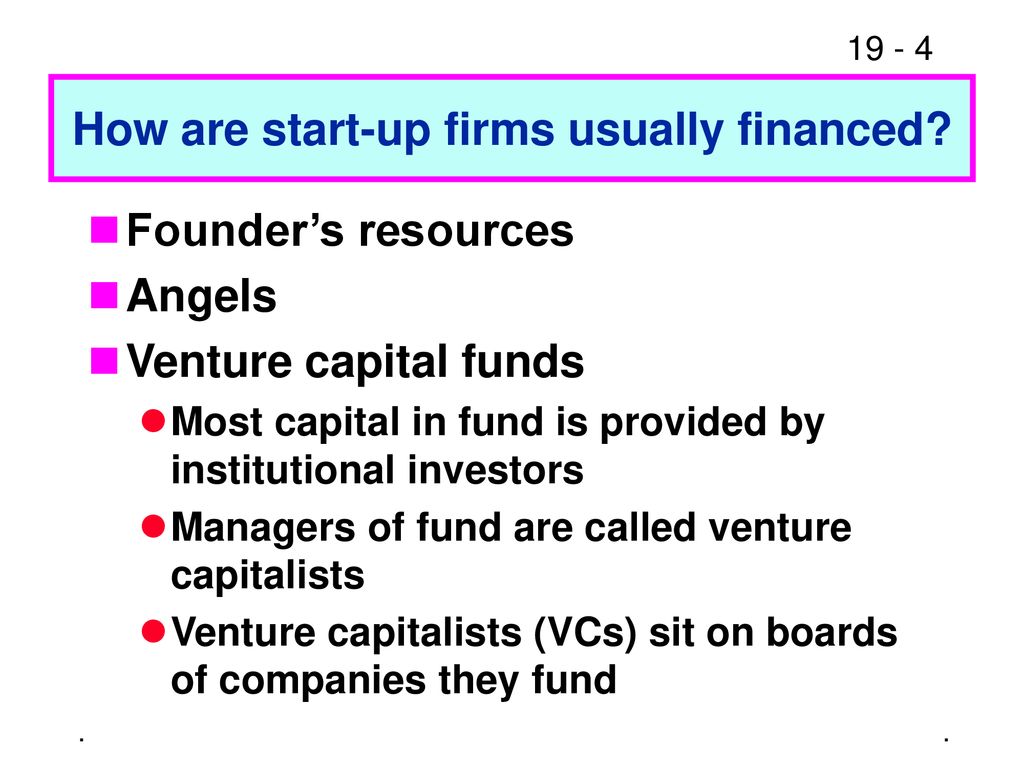

How Are Start Up Firms Usually Financed

Practice questions raising capital 1. So youve come up with an idea for a business.

Chapter 20 Initial Public Offerings Investment Banking And

Chapter 20 Initial Public Offerings Investment Banking And

how are start up firms usually financed is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark how are start up firms usually financed using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

What is the difference between public offering and private placement.

How are start up firms usually financed. It is usually a good idea to try to use a combination of two or even three or these sources to get the start up financing that you need for your new business. The proposed expansion would require the firm to raise about 15 million in new capital. Financing a start up company aan aa e after the stock market crash in 1929 the securities and exchange commission sec was established to protect investors from fraudulent investments and to regulate the securities industry based on your understanding of sec regulations which of the following statements are true.

Let me put that here 1. How are start up firms usually financed. They are useful for start up companies to encourage investment by minimizing downside risk while providing upside potential.

A startup is simply a business in the initial business stage. How are start up firms usually financed. There are several stages of startup funding.

Randys a family owned restaurant chain operating in alabama has grown to the point where expansion throughout the entire southeast is feasible. To get to this point they usually will raise funds privately one or more times. How start up firms are usually financed.

A startup is often financed by the founders until the business gets off the ground and the startup attracts outside investment. You just have to know where to look and think strategically and creatively. Here are the six most likely sources of start up financing for your new business.

The proposed expansion would require the firm to raise about 15 million in new capital. Explain the ipo process. When you are just starting out youre not at the point yet where a traditional lender.

Warrants warrants are a special type of instrument used for long term nancing. And thats where it becomes tricky. There are many different ways to fund startups.

You use the money from your savings or from 3fs friends family fools. A start up incubator is a company university or other organization that ponies up resources laboratories office space consulting cash marketing in exchange for equity in young companies when they are most vulnerable. Explain the main function of venture capitalist and angels.

For more check out getting the most out of a business incubator 6. What are the advantages and disadvantages of going public. Randys a family owned restaurant chain operating in alabama has grown to the point at which expansion throughout the entire southeast is feasible.

Self financed this is when you start building upon and idea prototype it. Seed stage once. Now you need startup financing that initial infusion of money needed to turn the idea into something tangible.

Chapter 19 Initial Public Offerings Investment Banking And

Chapter 19 Initial Public Offerings Investment Banking And

Chapter 19 Initial Public Offerings Investment Banking And

Chapter 19 Initial Public Offerings Investment Banking And

Initial Public Offering Investment Banking Ppt Video

Initial Public Offering Investment Banking Ppt Video

Fnce 3010 Chapter 18 Public And Private Financing Initial

Fnce 3010 Chapter 18 Public And Private Financing Initial

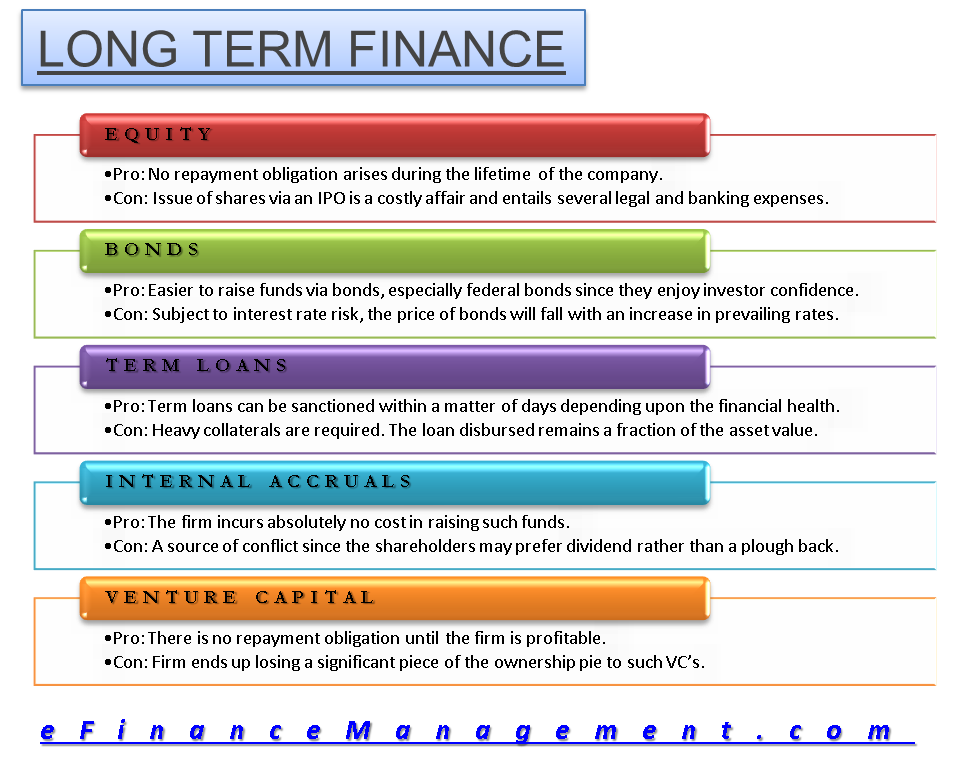

Long Term Finance Equity Bonds Term Loans Internal

Long Term Finance Equity Bonds Term Loans Internal

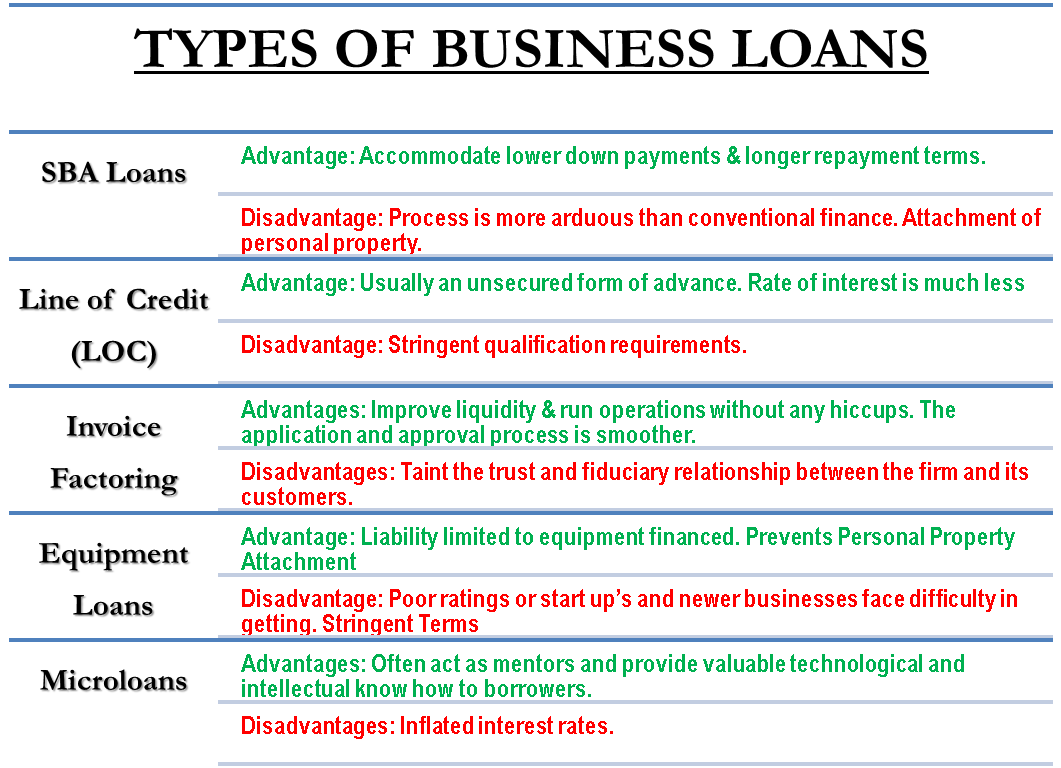

Types Of Business Loans Sbas Loc Factoring Equipment

Types Of Business Loans Sbas Loc Factoring Equipment

Initial Public Offerings Investment Banking And Financial

Initial Public Offerings Investment Banking And Financial

Who Are Angel Investors Importance Advantage

Who Are Angel Investors Importance Advantage

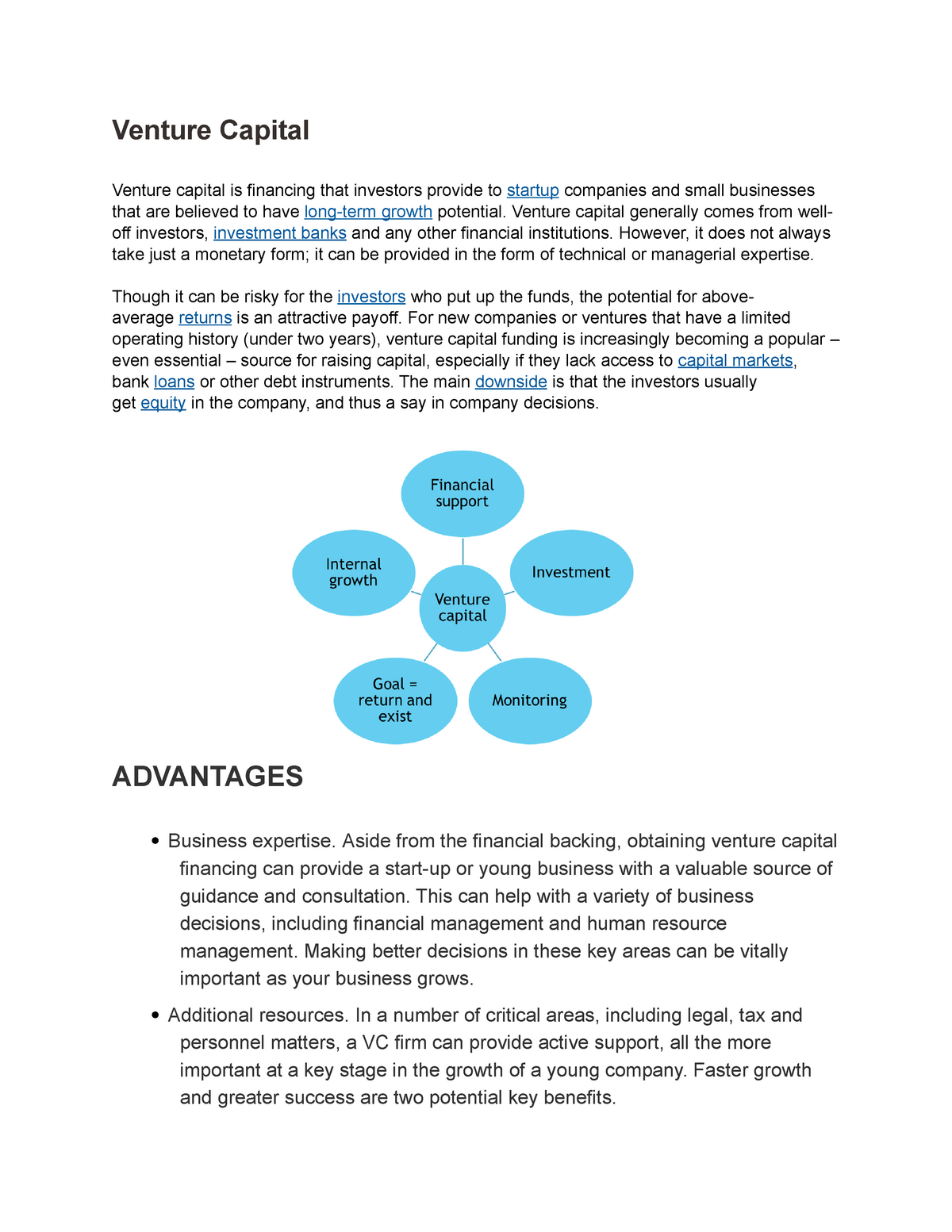

Venture Capital Corporate Finance Fin3014 Lancaster

Venture Capital Corporate Finance Fin3014 Lancaster

Table 1 From Venture Capital Financing And The Growth Of

Table 1 From Venture Capital Financing And The Growth Of