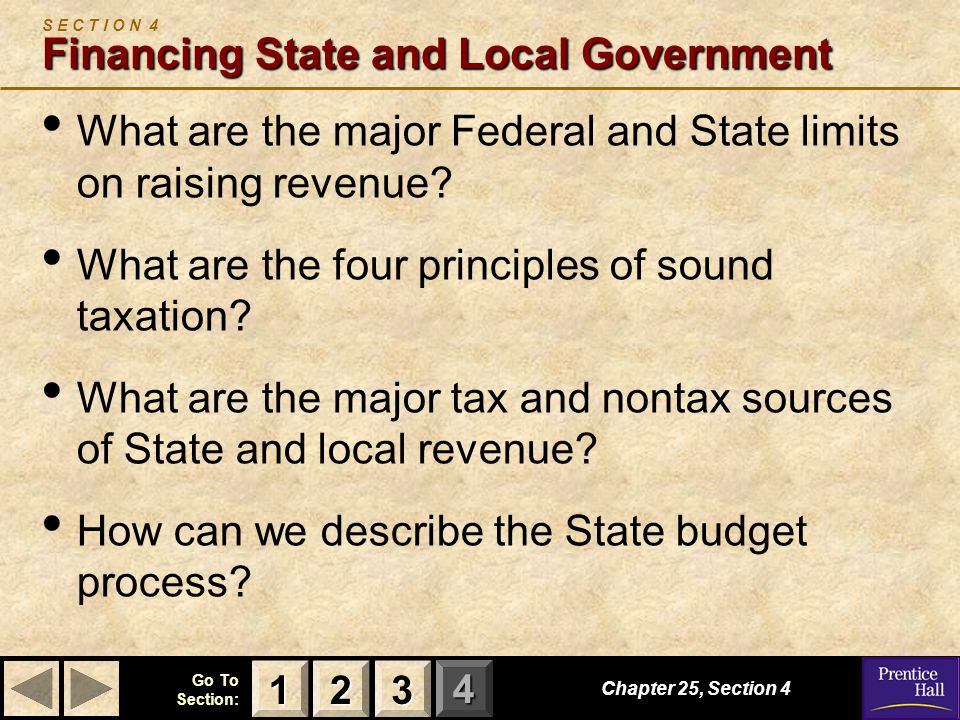

Chapter 25 Section 4 Financing State And Local Government

Generally taxes placed on the annual income of individuals and corporations are progressive. A major unit of local government in most states.

Chapter 25 Section 1 Counties Towns And Townships

Chapter 25 Section 1 Counties Towns And Townships

chapter 25 section 4 financing state and local government is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark chapter 25 section 4 financing state and local government using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Our library is the biggest of these that have literally hundreds of thousands of different products.

Chapter 25 section 4 financing state and local government. A subdivision of a county. Log in sign up. State and local governments use taxes to collect the revenue that pays for services.

Each group will develop possible solutions for state and local governments to raise money for programs and services. Log in sign up. Counties vary widely in area and population.

Mip state local government page chapter 25 section 4. 3 4 chapter 25 section 1 counties a county is a major unit of local government in most states. Chapter 25 section 4.

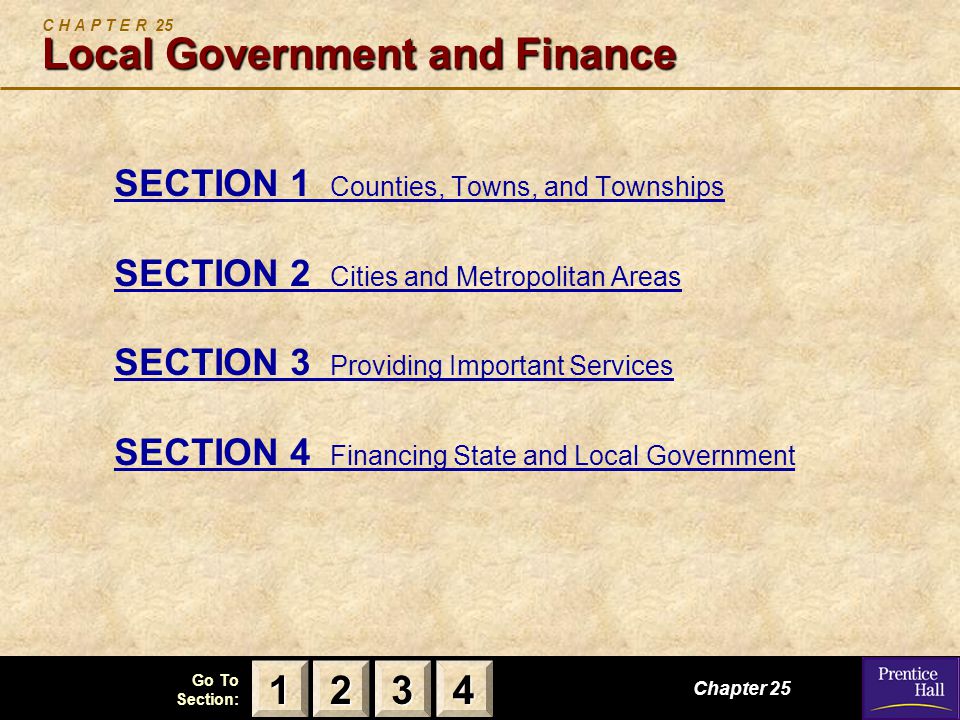

Assign the section assessment questions. Chapter 25 local government and finance. Chapter 25 vocab learn with flashcards.

Additional features for differentiated instruction can be found throughout the teachers edition. Financing state and local government the big idea. Chapter 25 section 4 guided reading and review financing state local government you are right to find our website which has a comprehensive collection of manuals listed.

Local government and finance. Financing state and local government audio support is available for this section. Taxes that are geared according to a persons ability to pay are called regressive taxes.

Microsoft powerpoint ch 25 local government and finance sec 4 notes author. Ive been meenan to tell ya american gov unit 97. Terms in this set 25 county.

The function of counties varies from state to they may share the functions of local government or be the major units of government for rural areas. Start studying government chapter 25. Learn vocabulary terms and more with flashcards games and other study tools.

The sales tax is probably the most difficult tax for a state to collect. Groups should consider several options including increasing business. Name class date section 4 guided reading and review.

The class will be divided into groups of four. 562003 local government municipal finance management act 2003 chapter 4. What is the cartoonist saying about property taxes.

Disputes between organs of state chapter 6 debt short term debt long term debt. Chapter resources essential questions journal. A municipalitys share of the local governments equitable referred to in 5 h.

Chapter 25 section 4 financing state and local government activity.

Magruder S American Government Ppt Video Online Download

Magruder S American Government Ppt Video Online Download

Magruder S American Government Ppt Video Online Download

Magruder S American Government Ppt Video Online Download

Magruder S American Government Ppt Download

Magruder S American Government Ppt Download

Chapter 25 American Government

Chapter 25 American Government

Chapter 4 Measuring Gdp And Economic Growth Pdf

Chapter 4 Measuring Gdp And Economic Growth Pdf

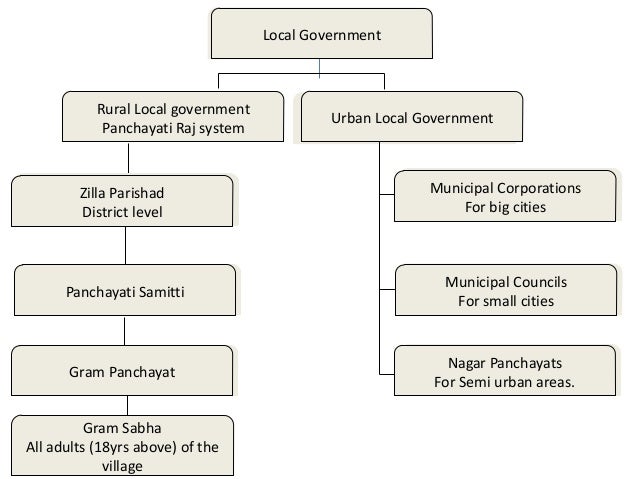

Nios Std X Social Science Ch 18 Local Government And Field

Nios Std X Social Science Ch 18 Local Government And Field

What Are The Sources Of Revenue For Local Governments Tax

What Are The Sources Of Revenue For Local Governments Tax

What Types Of Federal Grants Are Made To State And Local

What Types Of Federal Grants Are Made To State And Local

How Do State And Local Property Taxes Work Tax Policy Center

How Do State And Local Property Taxes Work Tax Policy Center

Federal Aid To State And Local Governments Center On

Federal Aid To State And Local Governments Center On