Barclays Mercantile Business Finance Ltd V Mawson

2003 btc 81 2002 ewca civ 1853. Barclays mercantile business finance ltd v mawson hm inspector of taxes.

Enterprise Investment Scheme Introduction To Taxation

Enterprise Investment Scheme Introduction To Taxation

barclays mercantile business finance ltd v mawson is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark barclays mercantile business finance ltd v mawson using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Appeal from barclays mercantile business finance ltd v mawson hm inspector of taxes ca 2002 sti 1809 bailii 2002 ewca civ 1853 2003 btc 81 2003 stc 66 the taxpayer entered into a sale and leaseback arrangement in respect of a gas pipeline and sought to set off the costs as a capital allowance.

Barclays mercantile business finance ltd v mawson. The nature of the case brought the supreme court back to analyse its judgment as the house of lords in barclays mercantile business finance ltd v mawson inspector of taxes 2005 stc 1. In this case barclays mercantile business finance bmbf finally succeeded in its contention that expenditure had been incurred on a gas pipeline and that this did qualify for capital allowances. Barclays mercantile business finance limited v mawson tony beare examines the recent decision by park j.

It was agreed with the inland revenue that the pipeline was plant for the purposes of capital allowances. G in substance there is only one issue. 76 decision a barclays m ercantile business finance ltd.

Barclays mercantile business finance limited v mawson irc v scottish provident the house of lords handed down judgment yesterday in the mawson and scottish provident cases. Barclays mercantile business finance limited respondents v. Pete miller of ernst young reviews the decision of the house of lords in barclays mercantile business finance v mawson.

In barclays mercantile business finance limited v mawson 2002 stc 1068 and explains why it is of some significance to a leasing industry still reeling after a spate of recent legislative changes. Mawson her majestys inspector of taxes appellant ordered to report the committee lord nicholls of birkenhead lord steyn lord hoffmann lord hope of craighead and lord walker of gestingthorpe have met and considered the causebarclays mercantile. 450 t a x c a se s v o l.

The appeal against this decision is reported at 2004 btc 414 peter gibson. Mawson and scottish provident are both significant cases on the application of uk case law anti avoidance. Barclays mercantile business finance limited respondents v.

Mawson her majestys inspector of taxes appellant ordered to report the committee lord nicholls of birkenhead lord steyn lord hoffmann lord hope of craighead and lord walker of gestingthorpe have met and considered the cause barclays mercantile business finance limited. B m b f appeals against notices o f determ ination o f trading losses for b m b fs accounting periods ended 31 december 1993 and 1994 and notices o f assessment to corporation tax for the same periods. Barclays mercantile business finance ltd v mawson.

The united kingdom supreme courts judgment in tower mcashback llp1 v hmrc was reported in the latest simons tax cases. Mawson is a significant case for the uk finance leasing industry. Court of appeal civil division.

Barclays mercantile business finance limited v mawson facts the disputed transaction in mawson was a sale and leaseback of parts of a pipeline which runs between scotland and ireland under the irish sea.

This Means Nothing To Me Taxation

This Means Nothing To Me Taxation

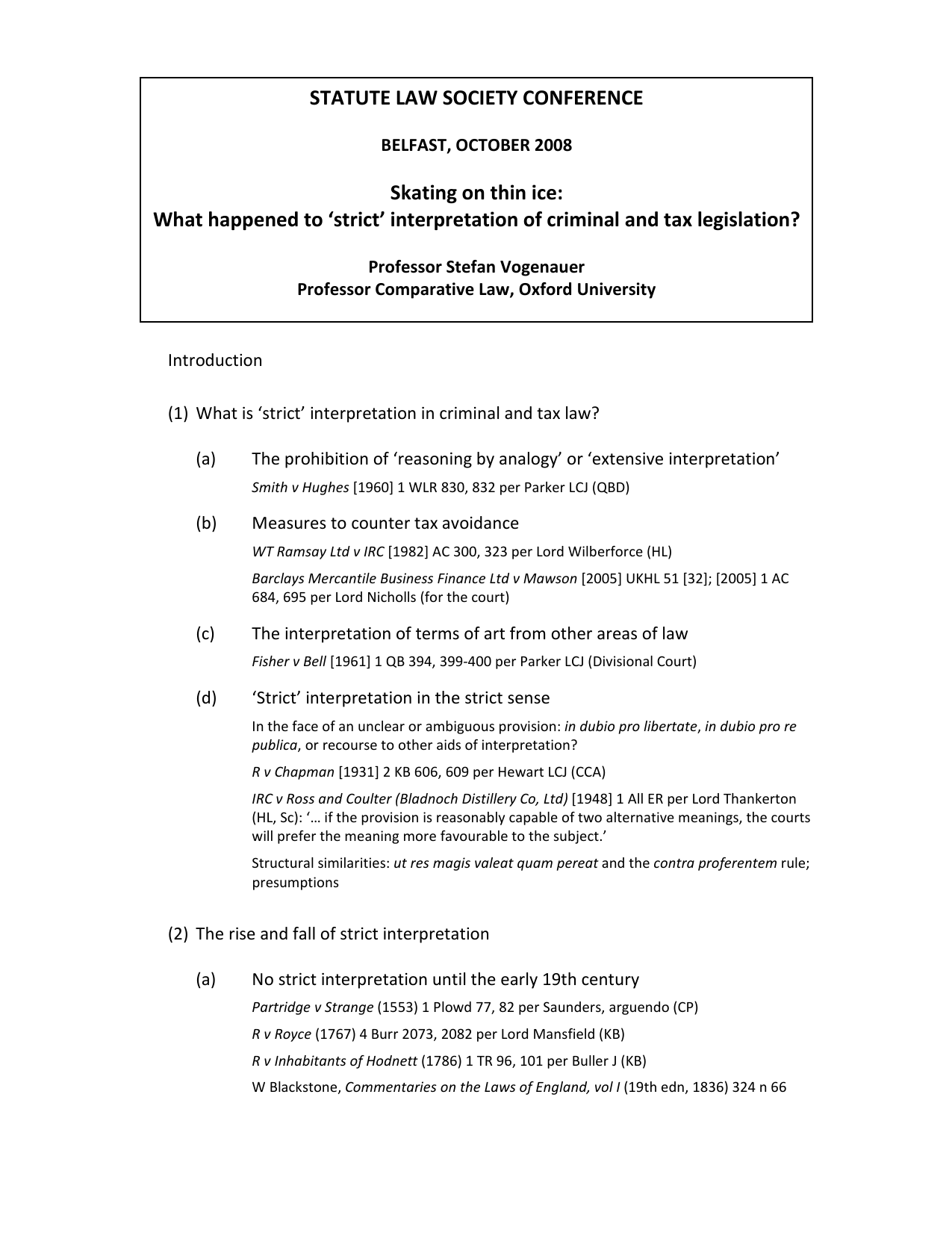

What Happened To Strict Interpretation Of Criminal And Tax

What Happened To Strict Interpretation Of Criminal And Tax

Vat Planning After Ocean Finance Taxation

Vat Planning After Ocean Finance Taxation

Enterprise Investment Scheme Introduction To Taxation

Enterprise Investment Scheme Introduction To Taxation

Pdf The Tax Avoidance Culture Who Is Responsible

Pdf The Tax Avoidance Culture Who Is Responsible

Breaking The Trust Of Football Fans The Rangers Fc Tax Case

Breaking The Trust Of Football Fans The Rangers Fc Tax Case

Pendragon Plc Stripestar Ltd Pendragon Company Car Finance

Pendragon Plc Stripestar Ltd Pendragon Company Car Finance

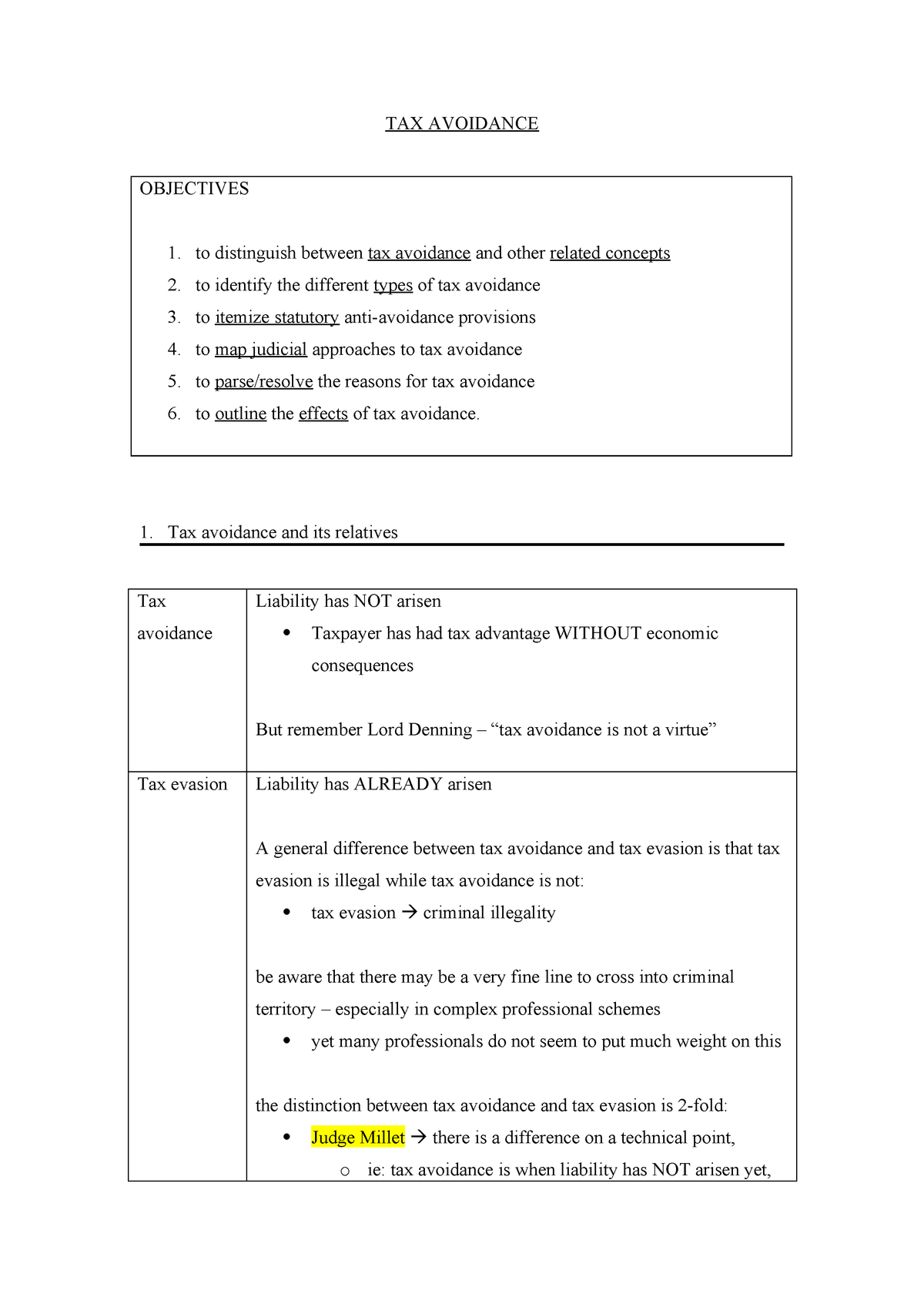

Tax Tax Avoidance Summary Revenue Law Law Warwick

Tax Tax Avoidance Summary Revenue Law Law Warwick