Can You Finance A Car With A Repossession

What this all means is that if you have a garage in which you normally keep your car locked then you can probably effectively hide your car to avoid. Car finance after repossession brings a new dawn in the history of buying and selling personal vehicles.

:max_bytes(150000):strip_icc()/does-hiding-a-car-to-avoid-repossession-actually-work-527154-final-5b64a4f546e0fb005076f503.png) What To Know About Hiding A Car To Avoid Repossession

What To Know About Hiding A Car To Avoid Repossession

can you finance a car with a repossession is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark can you finance a car with a repossession using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

If your car has been repossessed you were likely behind on payments and probably have blemished credit as a result.

Can you finance a car with a repossession. Make and follow a plan to bring past due balances up to date. As a result if you intend to hide your car thats going to include not using it. As you get farther away from the repossession and other negative credit your credit score will improve but getting your credit in order requires time commitment and discipline.

The repossession of vehicles from defaulters has risen to alarming levels. And avoid charging and borrowing when you can. Religiously pay your remaining bills on time to boost your credit.

Find out if you can get it back. Make sure you consistently pay bills on time. Often a bank or repossession company will let you get your car back if you pay back the loan in full along with all the repossession costs before its sold.

When you finance or lease a car you normally give the lender a security interest in the vehicle. While it is undoubtedly difficult if you take the time to improve your credit score and develop excellent credit habits it is possible to obtain a reasonable deal on a car loan after a six month to one year period has elapsed. As your credit improves due to timely payments you can add different lines of credit such as credit cards or personal loans so long as you can safely afford them.

Many people think that obtaining a car loan after repossession is impossible. This has not only affected the car owners the economy but also the car finance lenders business. Dont think that repo men wont keep an eye on your comings and goings to facilitate a repossession.

Every state has its own rules regarding repossession but having a security interest generally means your lender can repossess the car without notice if you default on the loan. Repossession is one of the most serious negative entries that can appear on your credit report so obtaining future financing will be a challenge. Before you get to that point learn how the process works what the issues are and what you can do about it.

Why is the lender allowed to repossess your car. Can you get a car loan after repossession. Taking out a hire purchase agreement means that the goods you have in your possession are in principle hired until the payment for the goods have been settled at which time you will be classed as the owner of the goods.

When you borrow money to buy a caror if you lease a caryou dont own the vehicle free and clear you get to drive it but the car can be taken away through repossession if you stop making payments. A car repossession can put a serious dent in your credit report.

Is It Possible To Get An Auto Loan After A Repossession

Is It Possible To Get An Auto Loan After A Repossession

Car Repossession And How To Avoid It Student Debt Relief

Car Repossession And How To Avoid It Student Debt Relief

How To Recover From A Car Repossession In 5 Steps Nerdwallet

How To Recover From A Car Repossession In 5 Steps Nerdwallet

Repossessed Cars What Are Repo Cars Carbuyer

Repossessed Cars What Are Repo Cars Carbuyer

/GettyImages-172242007-56a0f4785f9b58eba4b58680.jpg) How Repossession Works When The Bank Takes Your Car

How Repossession Works When The Bank Takes Your Car

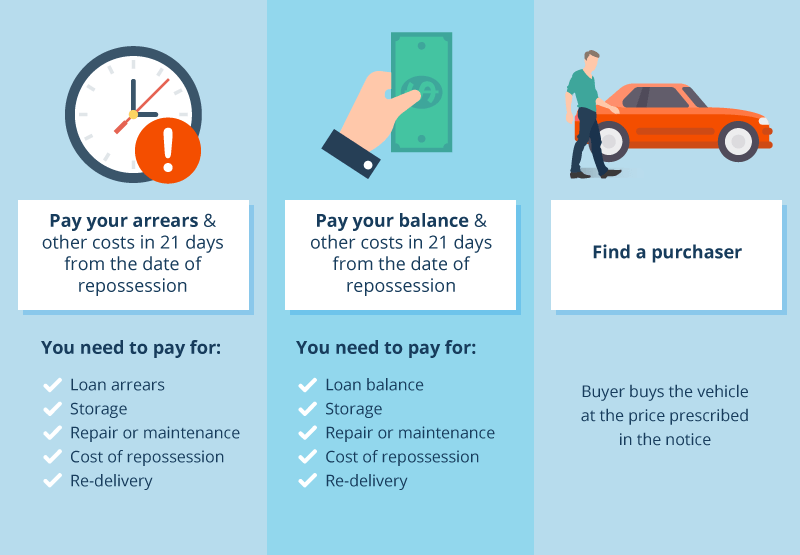

What To Do When Your Car Is Repossessed In Malaysia

What To Do When Your Car Is Repossessed In Malaysia

What To Do When Your Car Is Repossessed In Malaysia

What To Do When Your Car Is Repossessed In Malaysia

Repossessed Cars How Do They Work And What Laws Should You

Repossessed Cars How Do They Work And What Laws Should You

How Does A Repossession Affect Your Credit And How Can You

How Does A Repossession Affect Your Credit And How Can You

How To Prevent Vehicle Repossession

How To Prevent Vehicle Repossession