Finance Vs Operating Lease Under Asc 842

The treatment of operating and finance leases will differ on the income statement under the new asc 842 standard. A finance lease known as a capital lease under asc 840.

New Lease Accounting Top 10 Faqs Surrounding Asc 842

New Lease Accounting Top 10 Faqs Surrounding Asc 842

finance vs operating lease under asc 842 is free HD wallpaper was upload by Admin. Download this image for free in HD resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark finance vs operating lease under asc 842 using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Similar to finance leases under asc 842.

Finance vs operating lease under asc 842. For operating leases under the new asc 842. Subleases must be classified as either a finance or operating lease. The counterpart to finance leases are operating leases.

Classifying leases as operating or finance. Under asc 842. And presentation of expenses and cash flows from a lease will continue to depend on its classification as a finance or operating.

The cash flow really wont change much under asc 842 since the operating lease. Deloittes lease accounting guide examines how asc 842 will impact companies. Same as under existing us gaap.

Learn about the right of use rou asset and operating lease accounting under asc 842 with a full operating lease example for lessees. Finance lease vs. How lessee should account for finance and operating leases.

What is a sub lease and how do we account for subleasing under ifrs 16 and asc 842. Referred to as a finance lease under asc 842 and ifrs 16 is a lease that has. While the fasb is keeping a finance vs.

When a lessee or lessor should reassess its lease. Impact to the income statement. Summary of asc 842 a.

Already reporting under asc 842 and private. Form 990 is an annual information return required to be filed with the irs by most organizations that are exempt from income tax under section 501a of the internal.

Lease Accounting For Restaurants

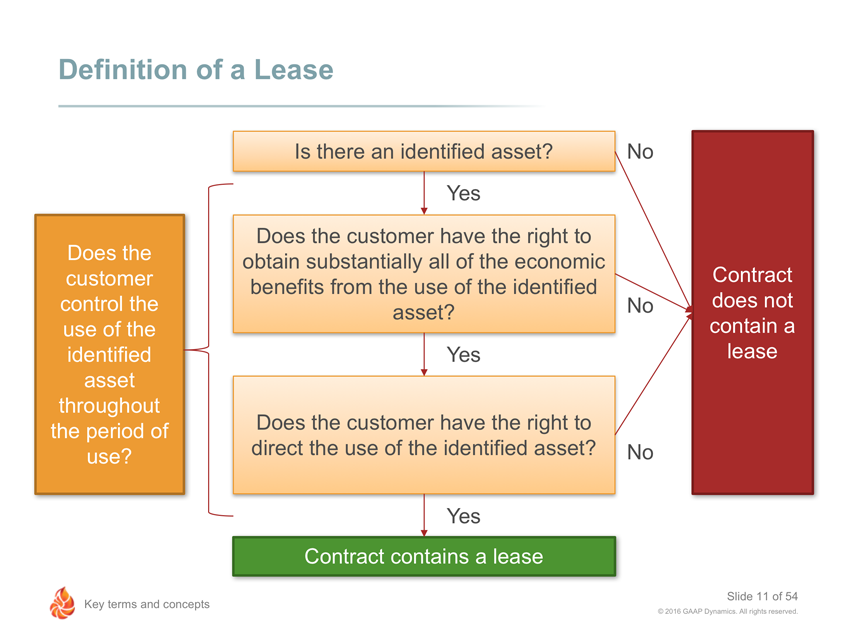

Is It A Lease It Matters When Moving From Asc 840 To Asc

Is It A Lease It Matters When Moving From Asc 840 To Asc

Faqs New Lease Accounting Standard Bfba Llp

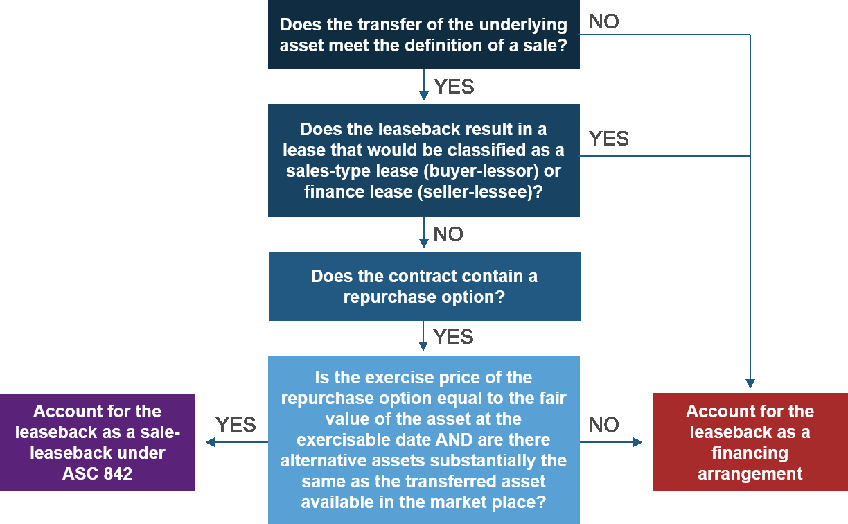

Sale And Leaseback Accounting Moving From Asc 840 To Asc

Sale And Leaseback Accounting Moving From Asc 840 To Asc

New Lease Accounting Standards For Lessees Asc Topic 842

New Lease Accounting Standards For Lessees Asc Topic 842

Changes To Lessees Financial Statements Under The New Lease

Changes To Lessees Financial Statements Under The New Lease

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx) Lease Accounting A Guide For Tech Companies Bdo Insights

Lease Accounting A Guide For Tech Companies Bdo Insights

Lease Accounting Changes Asc 842 Ifrs 16 Netsuite

Lease Accounting Changes Asc 842 Ifrs 16 Netsuite