Personal sources these are the most important sources of finance for a start up and we deal with them in more detail in a later section. The last four are sources that you should avoid at least.

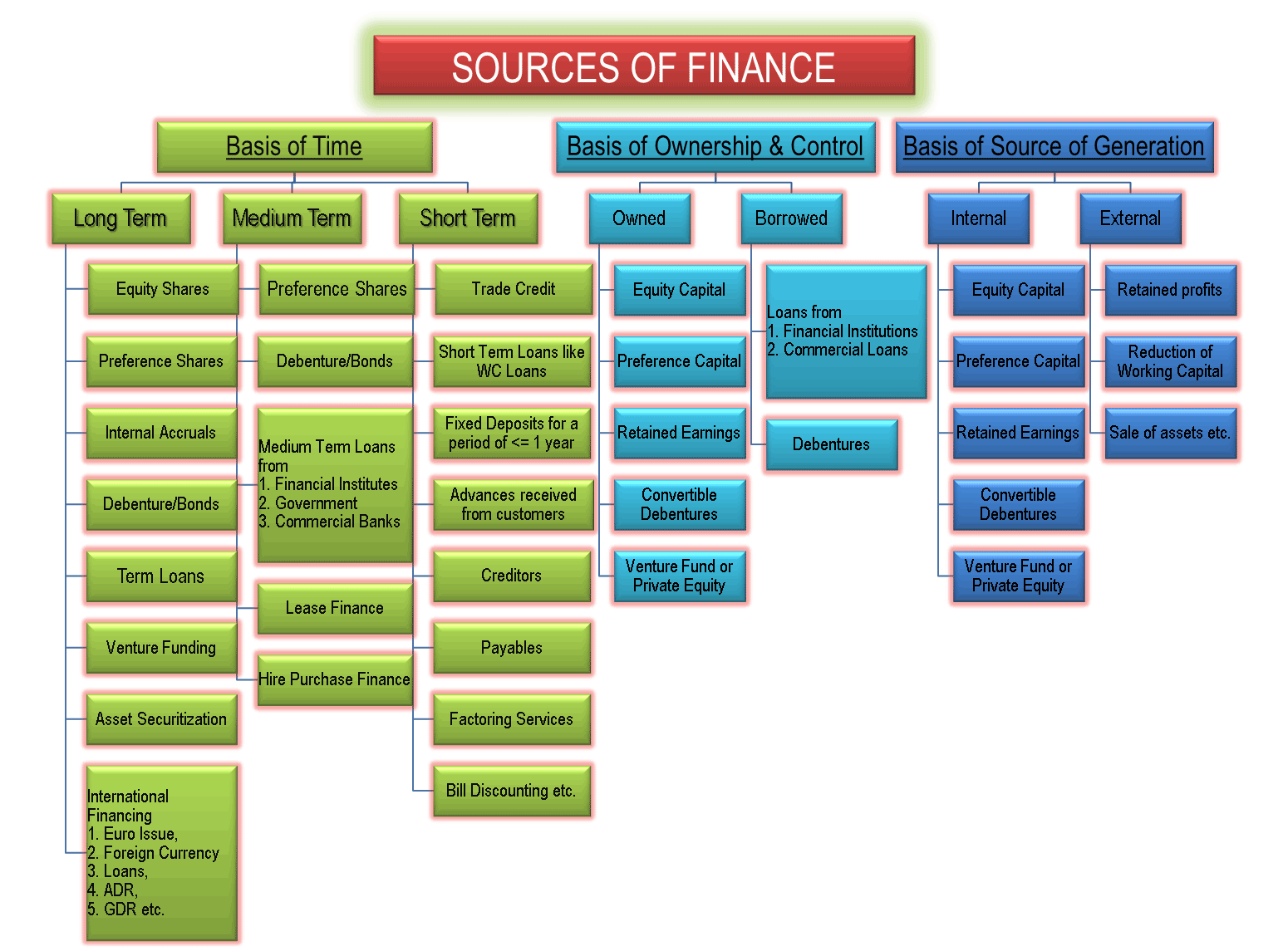

Sources Of Finance Owned Borrowed Long Short Term Internal

Sources Of Finance Owned Borrowed Long Short Term Internal

best sources of finance for a small business

best sources of finance for a small business is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in best sources of finance for a small business content depends on the source site. We hope you do not use it for commercial purposes.

Equity financing means offering a part in ownership interest in the company against finance.

Best sources of finance for a small business. Customers credit accounts as collateral for a short term loan from a bank commercial finance company or other financial. Retained profits this is the cash that is generated by the business when it trades profitably another important source of finance for any business large or small. You may also get money from business incubators and crowdsourcing campaigns.

Here are the 12 best from least attractive to most. Another method of obtaining financing for a small business is using accounts receivable ie. Debt financing means loans companies owe money and has to pay interest on the loan.

This guide lists thirteen sources of small business financing. Various sources of finance for a small business can be broadly categorized into equity or debt financing. Sources of finance for a partnership sole proprietorship or other small business include personal savings loans funds from personal contacts private investments small business grants and business credit cards.

The first nine are tried and proven ways to finance small businesses. Putting all your eggs in one basket is never a good business strategythis is especially true when it comes to financing your new business. Discover the best sources of finance your business and understand the advantages and disadvantages of each published by editorial team last update may 2 2020 when youre looking to start or expand a business there is always one major barrier.

They may not be perfect but they work. Five sources of financing every small business needs to know small businesses with lots of potential but a short track record need to be creative about raising funds mai nguyen april 17 2015 matt barnes t he fellas at. Not only will diversifying your sources of financing allow your start up to better weather potential downturns but it will also improve your chances of getting the appropriate financing to meet your specific needs.

Even with the best possible business plan in the world of business and finance you may not be able to convince a bank to loan any of their often scarce money available for credit for start up financing to a brand new business.

7 Start Up Financing Sources For Your Business Bdc Ca

7 Start Up Financing Sources For Your Business Bdc Ca

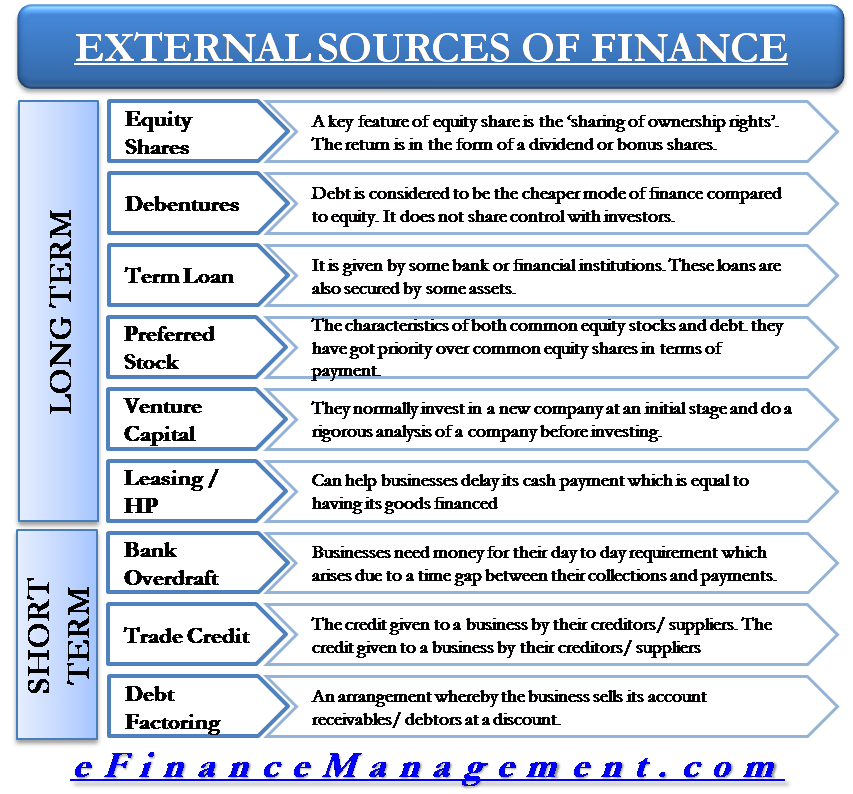

External Sources Of Finance Capital

External Sources Of Finance Capital

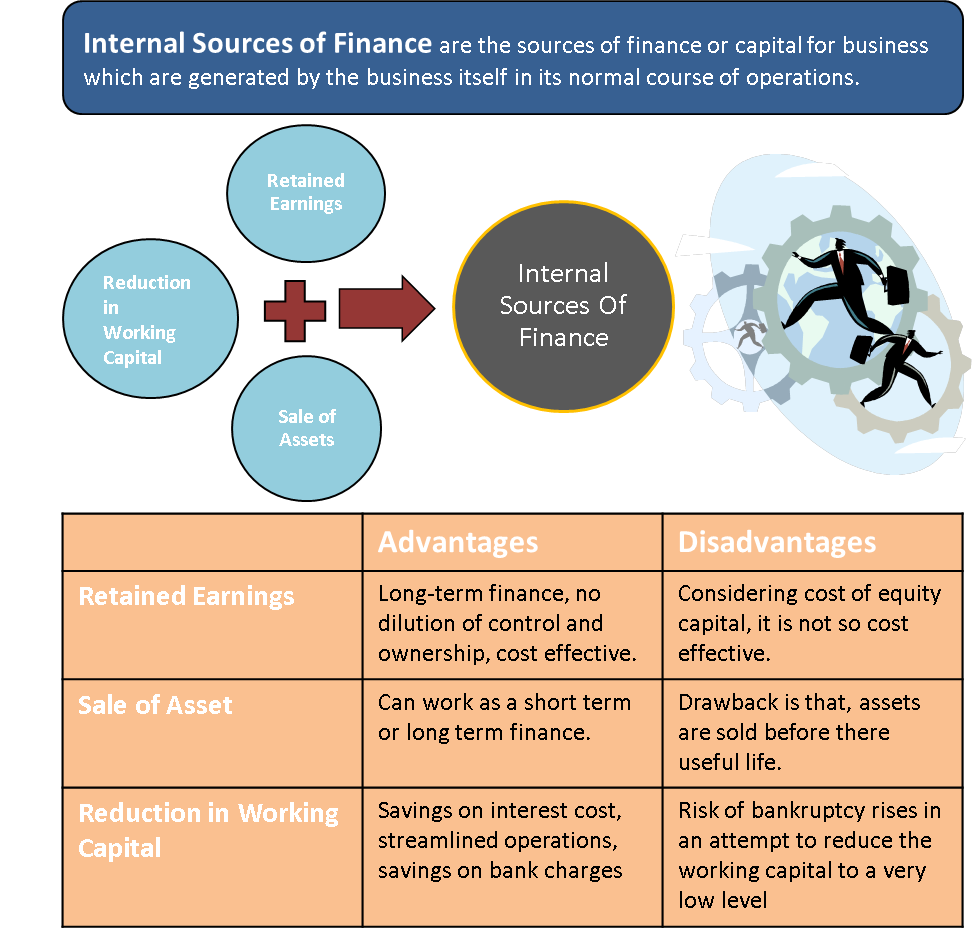

Internal Sources Of Finance Retained Profits Sale Assets Wc

Internal Sources Of Finance Retained Profits Sale Assets Wc

Sources Of Finance Bank Loans Business Tutor2u

Sources Of Finance Bank Loans Business Tutor2u

Sources Of Funds For Entrepreneurs And Small Businesses

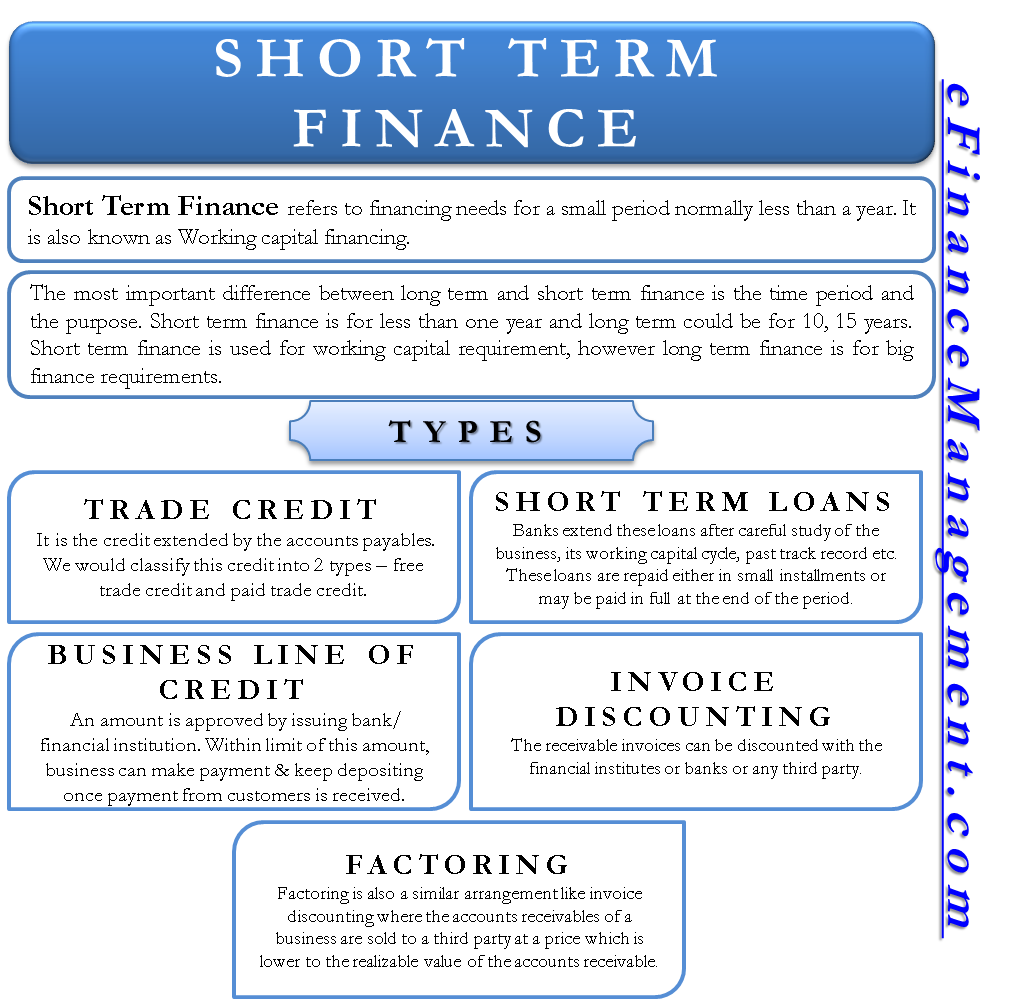

Short Term Finance Types Sources Vs Long Term

Short Term Finance Types Sources Vs Long Term

Top 14 Sources Of Funding For Businesses Entrepreneur Hadnbook

Top 14 Sources Of Funding For Businesses Entrepreneur Hadnbook

15 Sources Of Business Finance For Companies Sole Traders

15 Sources Of Business Finance For Companies Sole Traders

Sources Of Finance Bank Loans Business Tutor2u

Sources Of Finance Bank Loans Business Tutor2u

Best Sources Of Small Business Finance

Best Sources Of Small Business Finance

Business Loan Sources For Small Business Smarter Business

Business Loan Sources For Small Business Smarter Business