Small business owners may be able to get a new qualified business income deduction of 20 off certain business income in addition to normal business deductions. Take every legal deduction you can the best way to learn to do your own small business taxes is to educate yourself.

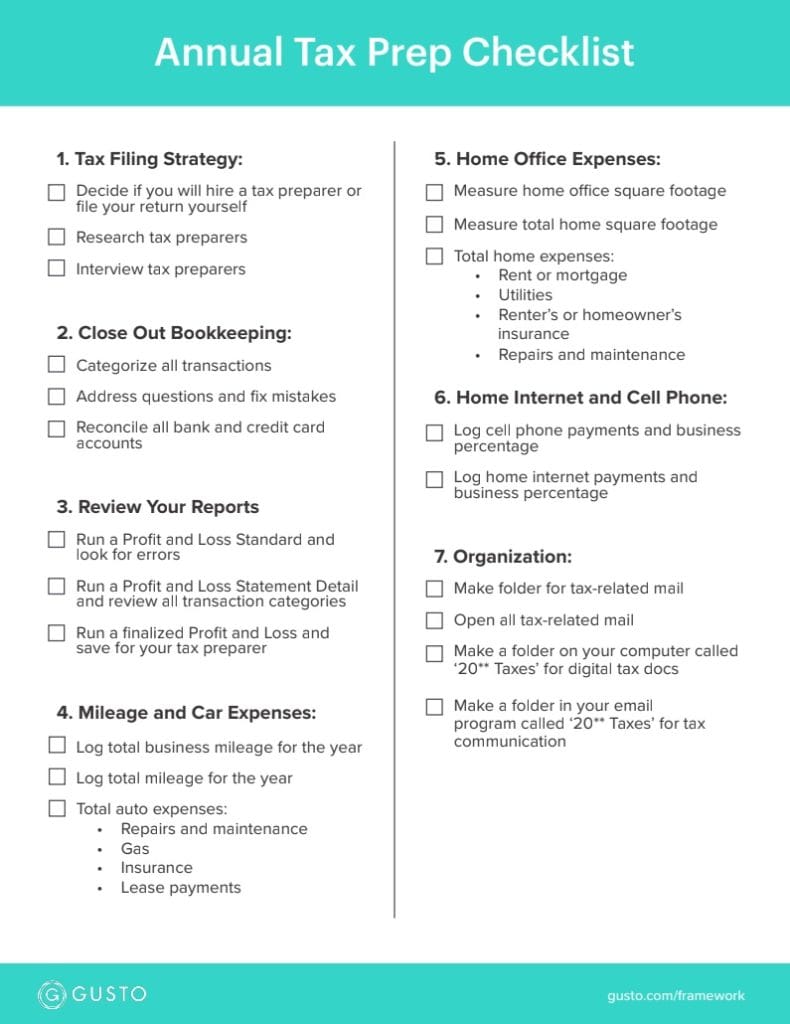

How To File Your Small Business Taxes Free Checklist Gusto

How To File Your Small Business Taxes Free Checklist Gusto

can i do my own small business taxes

can i do my own small business taxes is important information with HD images sourced from all the best websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i do my own small business taxes content depends on the source site. We hope you do not use it for commercial purposes.

The internet is full of sites that offer solutions to questions from small business owners.

Can i do my own small business taxes. Employment taxes for small businesses if you have employees you are responsible for several federal state and local taxes. If you dont pay them or dont pay enough you can be hit with penalties and interest and open yourself up to all kinds of unpleasantness. Freelancers independent contractors and small business owners who expect to owe at least 1000 in taxes need to estimate and pay quarterly taxes.

Filing taxes as a self employed small business owner. As an employer you must withhold federal income tax withholding social security and medicare taxes and federal unemployment tax act futa taxes. Ultimately whether you can successfully pull it off depends on your business type its complexity and your tax experience.

Small business and self employed employer id numbers business taxes reporting information returns self employed starting a business operating a business closing a business industriesprofessions small business events. The deduction can be taken starting in 2018 through 2025. For example 59 of individuals will pay someone.

If youre a small business owner or an entrepreneur youre possibly debating if you should do your own taxes or hire a tax professional. When its time to file a federal income tax return for your small business there are various ways you can do it depending on whether you run the business as a sole proprietorship or use a legal entity such as an llc or corporation. Along with the responsibility and rewards of being your own boss being self employed means that the way you file your income tax return also changes.

You can always attempt to do your own taxes or you can use business tax preparation software. Basically if you own a small business and it generates 100000 in profit in 2019 you can deduct 20000 before ordinary income tax rates are applied. There are a few limits however that could prevent you from claiming this deduction.

Youre not alone in this debate.

Small Business Taxes Definitive Guide On When And How To File

Small Business Taxes Definitive Guide On When And How To File

/GettyImages-536402315-57580ec75f9b5892e8e0d634.jpg) How Much Tax Do Small Businesses Pay

How Much Tax Do Small Businesses Pay

Yes You Can Diy Your Self Employed Taxes For Cheap Here S How To

Yes You Can Diy Your Self Employed Taxes For Cheap Here S How To

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks

Top Reasons Why You Should Hire Professional Accounting Services

Top Reasons Why You Should Hire Professional Accounting Services

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png) Tax Guide For Independent Contractors

Tax Guide For Independent Contractors

How To Do Small Business Accounting Is Diy The Way To Go

How To Do Small Business Accounting Is Diy The Way To Go

Are My Business Expenses Deductible Or Not Tax Tips For The

Are My Business Expenses Deductible Or Not Tax Tips For The

15 Common Tax Deductions For Small Business Owners Daveramsey Com

15 Common Tax Deductions For Small Business Owners Daveramsey Com

Small Business Tax Tips Are You Filing The Correct Forms Cbs

How To Start A Business In The Philippines Philippines Small

How To Start A Business In The Philippines Philippines Small