Lets take an example to calculate cash flow from financing activities when balance sheet items are provided. Cash flow from financing activities is the net amount of funding a company generates in a given time period used to finance its business.

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Formula Calculations

calculate the cash flows from financing activities is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark calculate the cash flows from financing activities using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

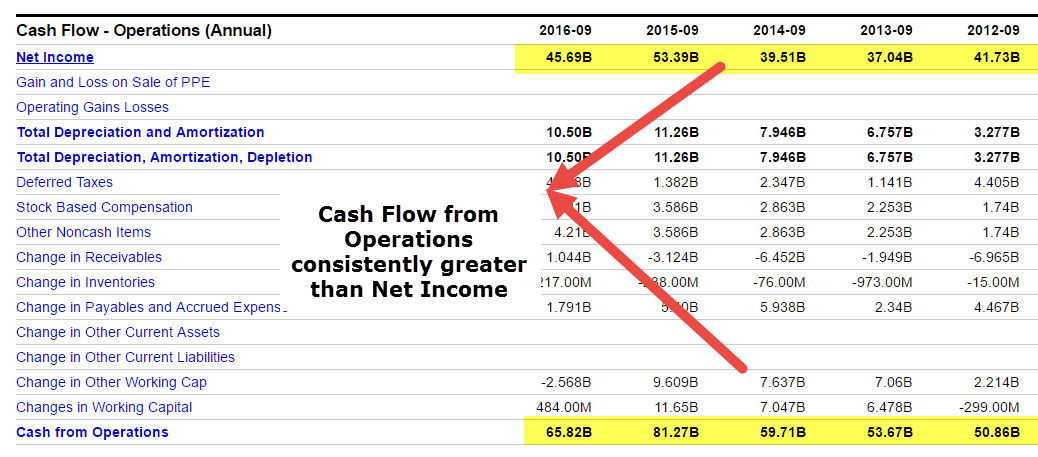

Calculate the net cash flow from operating activities.

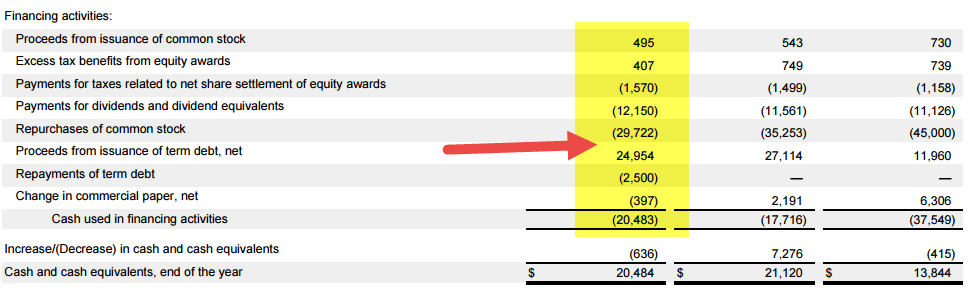

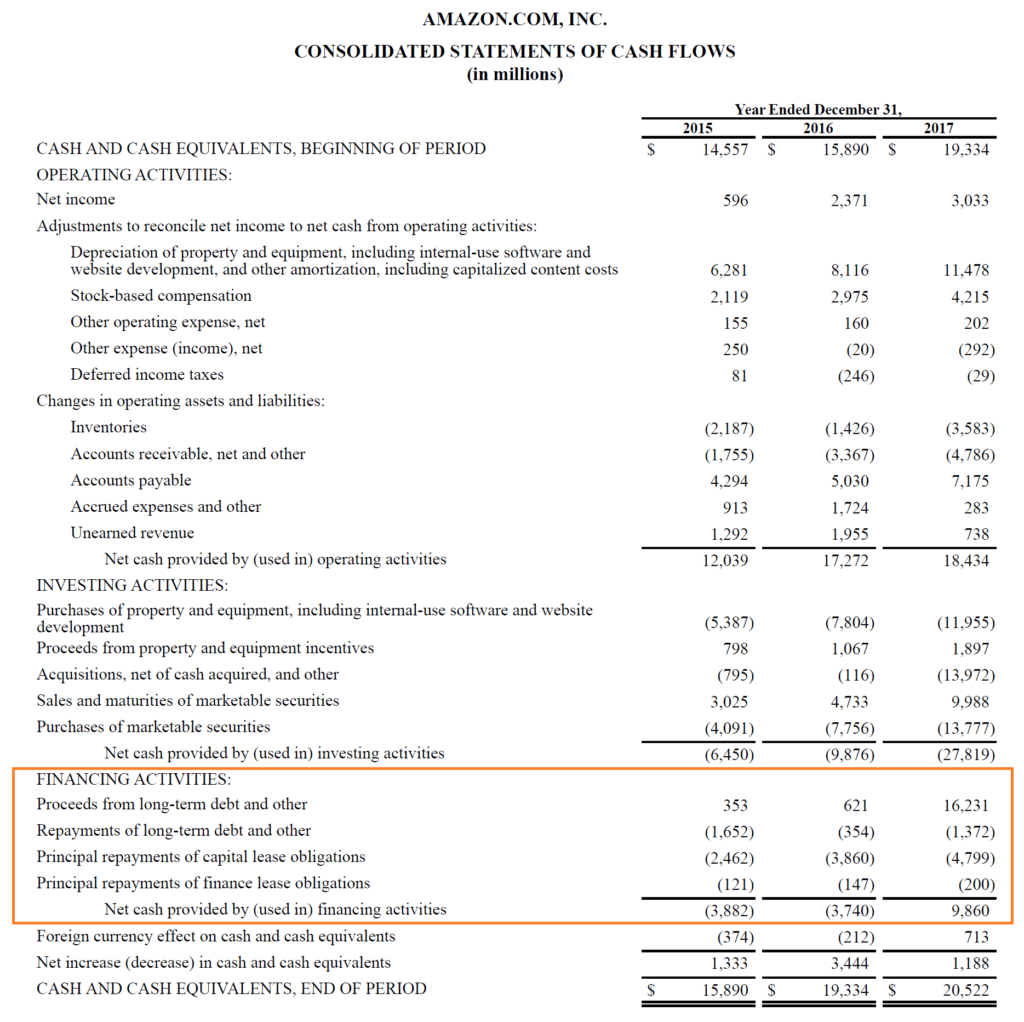

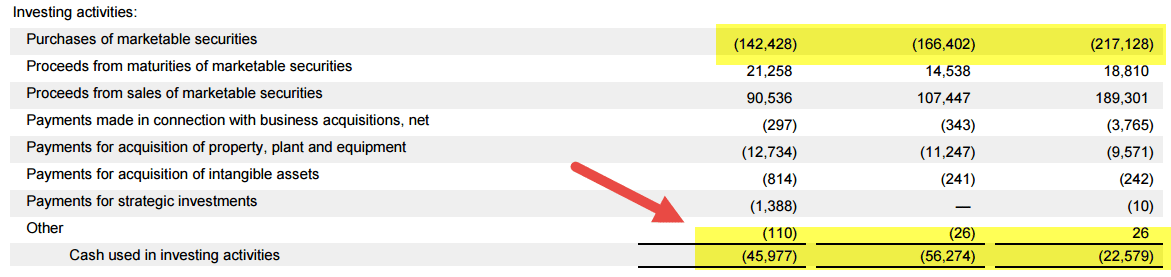

Calculate the cash flows from financing activities. In this example the net cash flow from financing activities is 1600. Calculating the cash flow from investing activities is simple. Include income from collection of receivables from customers and cash interest and dividends received.

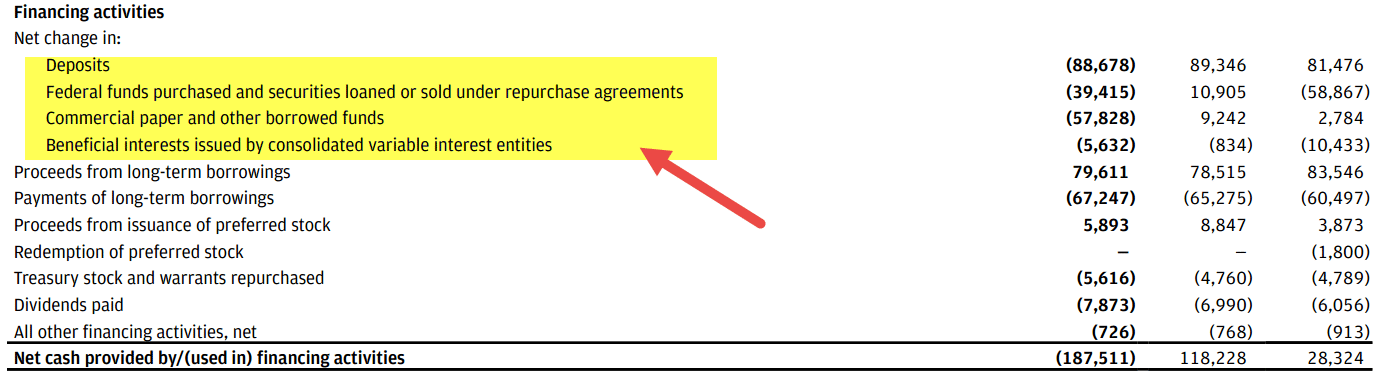

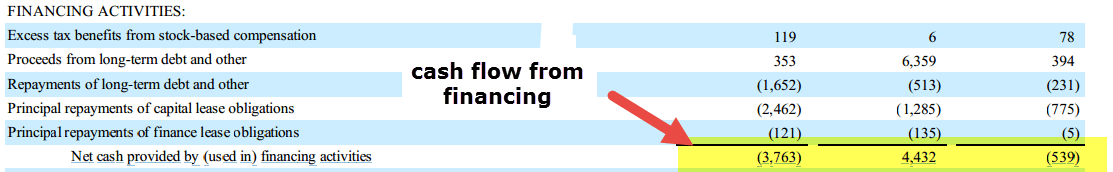

This statement is one of the documents comprising a companys financial statements. Cash flow from financing activities cff is a section of a companys cash flow statement which shows the net flows of cash that are used to fund the company. Add up any money received from the sale of assets paying back loans or the sale of stocks and bonds.

You can calculate net cash provided from financing activities to determine its reliance on outside. Net cash provided by financing activities equals total cash inflows minus total cash outflows from the financing activities section and is the positive amount of cash that the companys financing activities contribute to its cash balance. Cash flow from financing activities example.

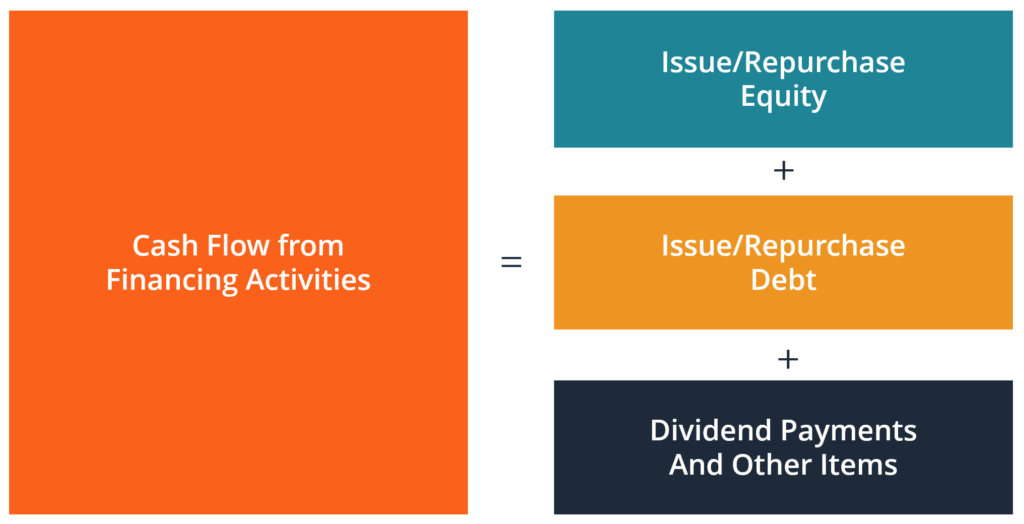

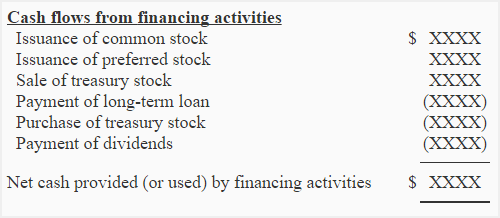

Below is a balance sheet of an xyz company with 2006 and 2007 data. Financing activities include transactions involving debt equity and dividends. Finance activities include the issuance and repayment of equity payment of dividends issuance and repayment of debt and capital lease obligations.

Subtract money paid out to buy assets make loans or buy stocks and bonds. Financing activities include transactions involving debt equity and dividends. Cash flows from financing activities is a line item in the statement of cash flows.

The owners and the creditors of the company. Add up the inflow or money that came in from daily operations and delivery of goods and services. Cash flow from financing activities cff is a section of a companys cash flow statement which shows the net flows of cash that are used to fund the company.

Next calculate the outflow. The line item contains the sum total of the changes that a company experienced during a designated reporting period that were. It shows the cash inflows and outflows related to transactions with the providers of finance ie.

The total is the figure you need. To calculate cash flow from financing activities all of the cash inflows and outflows associated with obtaining or repaying capital are summed. Cash flows from financing activities is the last of the three sections of a statement of cash flows.

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Formula Example Calculation

Cash Flow From Financing Activities Formula Example Calculation

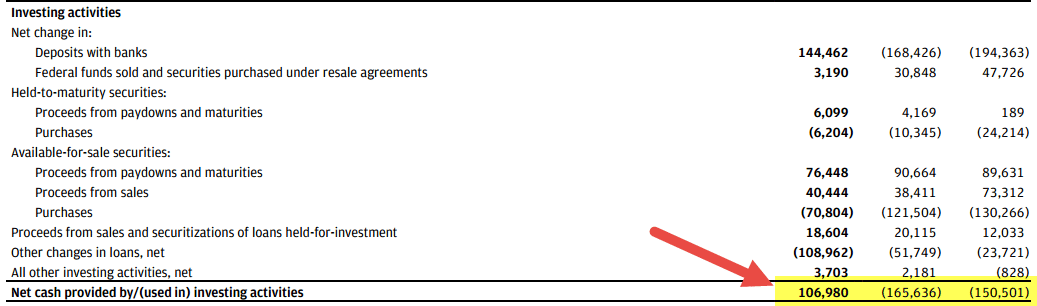

Cash Flow From Investing Activities Formula Top Examples

Cash Flow From Investing Activities Formula Top Examples

Cash Flow From Financing Activities Overview Examples

Cash Flow From Financing Activities Overview Examples

Cash Flow From Financing Activities Overview Examples

Cash Flow From Financing Activities Overview Examples

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Formula Calculations

Financing Activities Section Of Statement Of Cash Flows

Financing Activities Section Of Statement Of Cash Flows

Cash Flow From Investing Activities Formula Top Examples

Cash Flow From Investing Activities Formula Top Examples

Cash Flow From Investing Activities Overview Example

Cash Flow From Investing Activities Overview Example

Cash Flow From Investing Activities Formula Top Examples

Cash Flow From Investing Activities Formula Top Examples